The $1.1 trillion market for commercial paper used to buy assets from mortgages to car loans has seized up just as more than half of that amount comes due in the next 90 days, according to the Federal Reserve. Unless they find new buyers, hundreds of hedge funds and home-loan companies will be forced to sell $75 billion of debt backed by mortgages, according to Zurich-based UBS AG, Europe's largest bank.

Those sales would drive down prices in a market where investors have already lost $44 billion, based on Merrill Lynch & Co.'s broadest index of floating-rate securities backed by home-equity loans. That may hurt the 38.4 million individual and institutional investors in money market funds, the biggest owners of commercial paper.

``We're dumping all this collateral into the market and it becomes a death spiral for the assets,'' said Brian McManus, head of collateralized debt obligation research at Charlotte, North Carolina-based Wachovia Corp., the fourth-biggest U.S. bank by assets. CDOs contain pools of mortgage securities that have been repackaged and sliced into pieces.

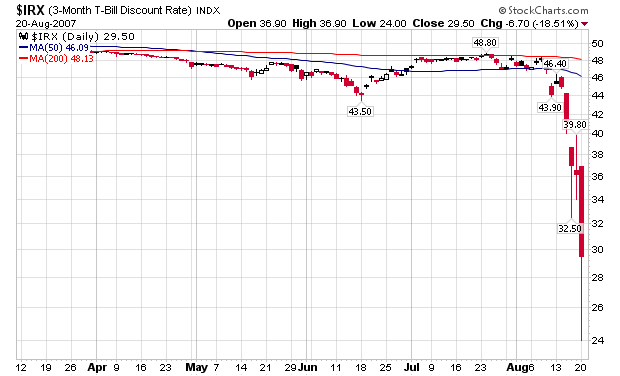

This is the big reason the Fed shouldn't lower rates. Just because banks have more money to lend doesn't mean they will be able to find borrowers or steer those borrowers to a certain type of asset. The bottom line is investors and borrowers aren't touching anything right now. No matter how much cash they have, they won't go near anything except T-Bills:

This is an issue of confidence. The market doesn't have any right now and the Fed can't give it to the market.

All of this will lead to higher short-term costs for US companies, which is already hitting riskier credits:

The buyers' strike has hit the riskier commercial paper - that issued by companies with lower credit ratings - and whose yields have jumped more than 10 per cent in a month.

According to the US Federal Reserve, these companies now have to pay an average interest rate of 5.9 per cent on their floating rate, 30-day commercial paper compared with 5.36 last month.

"Liquidity concerns re-main the paramount issue for investors amid current volatile market conditions," Lehman Brothers credit strategists wrote in a note to analysts last week.