Refiners say there are a variety of reasons behind the lingering outages, including tougher federal clean-fuel standards. But industry observers also cite wear and tear on aging equipment in a nation where no new refinery has been built since the 1970s.

Because capacity hasn't grown as much as demand in the past few years, refiners have been running their equipment harder and for longer periods without maintenance, making for extended shutdowns when they do stop to fix things. A shortage of skilled labor is also pushing maintenance projects, normally scheduled in the winter or the spring, into the summer months. The strains point to a lingering trouble spot in the nation's energy stream at a time when Americans show little sign they will curb gasoline use anytime soon.

.....

The shutdowns have put a growing portion of the nation's oil-refining capacity -- currently 17.5 million barrels a day -- out of circulation at a time when demand is at its highest. The Energy Information Administration recently said the refinery utilization rate had sunk to 87.6%. On average, refineries used about 94% of their capacity this time of year from 2001 to 2005. Even last year, when refineries were still recovering from damage suffered during hurricanes Katrina and Rita in 2005, the utilization rate ran at 93%.

While the public is groaning about high gasoline prices, refiners have seen their profit margins soar. In the first quarter, the major gasoline producers in the U.S. made about $10 billion in refining profits domestically and abroad, up 50% from a year earlier. Daniel Barcelo, an analyst with Banc of America Securities, expects refining margins, or the difference between the price refiners pay for oil and the prices their fuels fetch, to be even higher in the second quarter.

I've spent a fair amount of time talking about gas prices for two reasons.

1.) Consumers see these prices every day and have to pay them at least once a week if not more. As a result, higher prices could have a direct result on consumer spending.

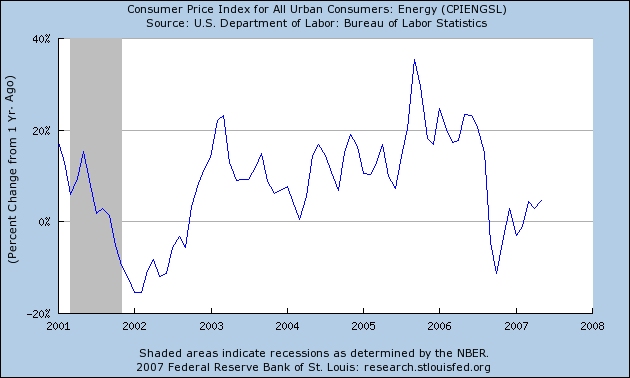

2.) Higher gas prices increase the total inflation rate. Here is a chart from the St. Louis Federal Reserve of the year over year change in the inflation rate for energy since 2001. This chart indicates energy prices have been increasing at high rates for the last 7 years.

So far, consumer spending as expressed by personal consumption expenditures has increased smartly, indicating high gas prices aren't hitting total spending. However, it's important to keep an eye on this situation.

In addition, it appears there are serious problems developing with the US refining industry. They have run a near full capacity during previous years, yet the wear and tear is starting to take a toll.