The U.S. trade deficit narrowed more than expected in October as the price of imported oil dropped and faster growth abroad boosted exports to a record.The gap fell 8.4 percent, the biggest decrease in almost 5 years, to $58.9 billion, the Commerce Department said today in Washington. The improvement came despite a record deficit with China, which surpassed Mexico as the nation's second-biggest trading partner.

A weaker dollar and growing demand from Europe and Asia may spur exports and limit weakness in manufacturing, which would help prevent the economy from sinking as housing slumps. Federal Reserve policy makers today will probably keep their interest- rate target steady as they count on more moderate growth to eventually bring down inflation.

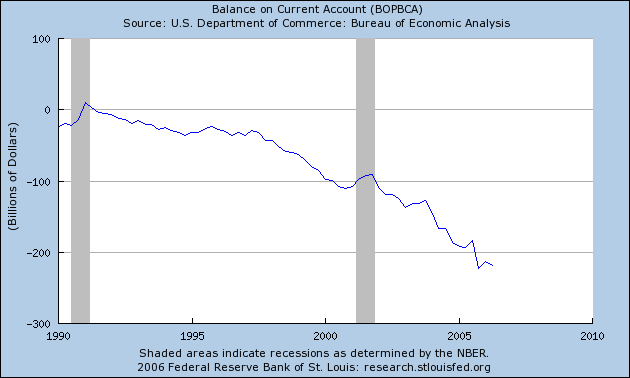

Now before we get too excited, let's look inside the numbers and get an idea about the overall trend. Here's a 15-year chart of the trade deficit from the St. Louis Fed:

The chart indicates we have a serious long-term deterioration happening. One month won't change that.We're already $54,884 billion ahead of last year's January to October period. We're also only $73,290 billion behind last years total trade deficit. So we're still on target to set another record this year.

Imports increased 12% from 2004 -2005 while exports increased 10%. So far, exports for the January - October period have increased 13% while imports have increased 11.71%. So from a statistical perspective, exports will have to make a big jump to make a serous dent in the trade deficit.

Finally, there is oil. Oil is a big reason for the recent acceleration of the US trade deficit. The Federal Reserve Bank of San Francisco did s study of the situation and made the following conclusion:

Oil prices have almost quadrupled since the beginning of 2002. For an oil-importing country like the U.S., this has substantially increased the cost of petroleum imports. International trade data suggest that this increase has exacerbated the deterioration of the U.S. trade deficit, especially since the second half of 2004. One factor can explain this evolution: The real volume of U.S. petroleum imports has remained essentially constant. One explanation for why the demand for petroleum imports has not declined in response to higher prices comes from a model in which firms are fairly limited in their ability to adjust their use of energy sources, such as oil, in the short term.Of course, the mechanism underlying this model may imply that it could take a while for the U.S. trade deficit to adjust in response to persistently higher oil prices, as businesses need time to install new, less energy-intensive equipment. However, one positive and important implication is that eventually the U.S. economy will become more energy-efficient, which, in turn, would help contain the cost of oil imports and increase the economy's flexibility in absorbing future oil price increases.

While oil prices have dropped over the last few months, they are in a trading range between $60 -$64 a barrel. OPEC has announced one production cut and another one is rumored to be in the works. While the slowing US economy is a net negative for oil prices, China and India are growing at very fast rates putting upward pressure on oil. European and Japanese growth rates are increasing. In other words, there is a lot of macro-level support for oil prices at their current level.

So while the trade deficit's one month decrease is good news, there are still important structural reasons for the deficit to remain high for some time.