For those of you who are not dog people, here is a video from YouTube that I have always found to be really funny.

Nonfarm payroll employment was essentially unchanged (-4,000) in August, and the unemployment rate remained at 4.6 percent, the Bureau of Labor Statistics of the U.S. Department of Labor reported today. Over the last 3 months, total payroll employment changes have averaged 44,000 per month and private sector employment changes have averaged 72,000 per month (as revised). In August, employment in manufacturing, construction, and local government education declined, while job growth continued in health care and food services.

Manufacturing employment declined by 46,000 in August. This industry has lost 215,000 jobs over the past year. In August, declines were widespread among component industries. Within durable goods, there were job losses in motor vehicles and parts (-11,000), machinery (-7,000), wood products (-7,000),furniture and related products (-4,000), and semiconductors and electroniccomponents (-4,000). In nondurable goods manufacturing, job losses continued in apparel (-4,000) and in textile mills (-2,000).

Construction employment declined in August (-22,000), with most of the loss occurring among residential specialty trade contractors. Since its most recent peak in September 2006, construction employment has fallen by 96,000.

The jobs report. This leaves tomorrow jobs data as the key economic report before the Fed meeting September 18th. There have been some signs of weakness in the employment trends recently. Very strong data will clearly reduce the chances of a cut; very weak data will revive the belief a cut is imminent. The worst case scenario for the stock market is a jobs report that is in line or just slightly below expectations; this will leave traders confused about the Fed's intentions and put more weight on the weekly jobless claim numbers.

Federal Reserve officials said Thursday that current economic conditions are good and the financial turmoil hasn't hurt Main Street.

In a luncheon speech to the Atlanta Press Club, Atlanta Federal Reserve President Dennis Lockhart said there are no signs of spillover from the housing and mortgage market woes into other sectors of the economy such as consumer spending.

Lockhart said his comment relied on real-time information from business contacts around the South because much of the new government indicators are "backward looking."

"So far, I have not seen hard or soft data that provide conclusive signs that housing problems are spilling over into the broad economy," Lockhart said.

His remarks echo the sentiment in the Fed's Beige Book report on current economic conditions that found that growth continued across the country at a moderate pace through August with little sign that the credit crunch and financial turmoil have slowed activity. See full story.

But in an earlier statement to reporters following a speech in London, St. Louis Fed President William Poole said the risks of recession have risen as a result of the market turmoil. But Poole said, "I don't think we should take for granted that the economy is going to nosedive."

Later in the afternoon, Dallas Fed President Richard Fisher was upbeat about current conditions.

In answer to a question after a speech in El Paso, Fisher said recent economic data has been "rather positive," and pointed specifically to the August ISM services index, which was unchanged at 55.8%.

Four regional Federal Reserve bank presidents declined to endorse a cut in the benchmark interest rate this month, as policy makers gauge the impact of the credit- market rout on the U.S. economy.

The delinquency rate for mortgage loans on one-to-four-unit residential properties stood at 5.12 percent of all loans outstanding in the second quarter of 2007 on a seasonally adjusted (SA) basis, up 28 basis points from the first quarter of 2007, and up 73 basis points from one year ago, according to MBA’s National Delinquency Survey.

The delinquency rate does not include loans in the process of foreclosure. The percentage of loans in the foreclosure process was 1.40 percent of all loans outstanding at the end of the second quarter, an increase of 12 basis points from the first quarter of 2007 and 41 basis points from one year ago.

The rate of loans entering the foreclosure process was 0.65 percent on a seasonally adjusted basis, seven basis points higher than the previous quarter and up 22 basis points from one year ago. This quarter’s foreclosure starts rate is the highest in the history of the survey, with the previous high being last quarter’s rate.

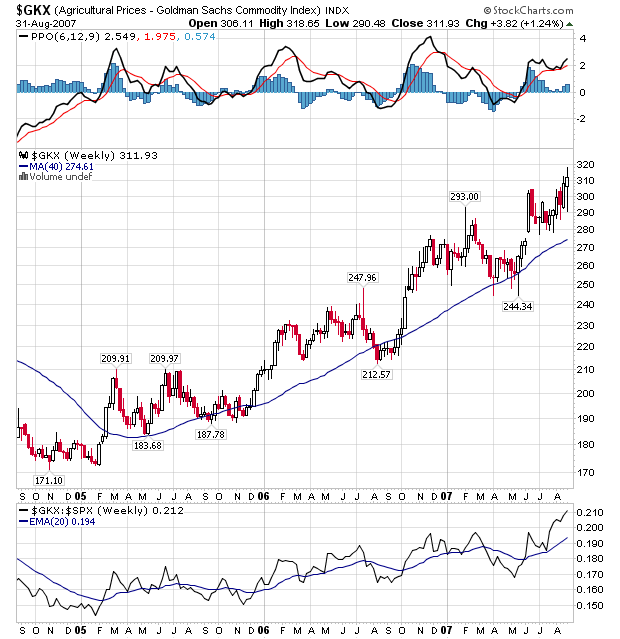

"The genie's out of the bottle when it comes to food inflation," said Michael Swanson, an agricultural economist at Wells Fargo & Co.

.....

Corn prices over the past year have reached near-record highs thanks to growing production of ethanol, which is made from the grain, as well as rising demand. Corn futures closed at $3.29 a bushel yesterday on the Chicago Board of Trade, up from about $2.89 a bushel last year.

Prices have softened some because of this year's bumper crop. U.S. farmers are in the process of harvesting 13.1 billion bushels of corn, up 24% since last year and the largest crop since 1933, says the Agriculture Department. But it's unlikely that the crop will send prices down to levels seen a year ago.

The higher grain costs have trickled down throughout production lines. Mr. Bond cited the price of corn, the predominant feed for cattle, as a problem for Tyson's beef business. Prices for live fed cattle averaged about $93 per hundred-weight through August, versus about $85 last year, said Kevin Good, senior analyst at Cattle-Fax, a cattle marketing information firm based in Englewood, Colo.

Consumers can expect to pay as high as 4.5% more for groceries and restaurant meals this year over last, according to the Agriculture Department. That means shoppers who spent $100 on groceries during an average shopping trip last year can expect to pay as much as $104.50 this year for the same groceries.

Most Banks reported that the recent developments in financial markets had led to tighter lending standards for residential mortgages, which was having a noticeable effect on housing activity, and several noted that the reduction in credit availability added to uncertainty about when the housing market might turn around. While several Banks noted that commercial real estate markets had also experienced somewhat tighter credit conditions, a number commented that credit availability and credit quality remained good for most consumer and business borrowers. Outside of real estate, reports that the turmoil in financial markets had affected economic activity during the survey period were limited.

It is not the responsibility of the Federal Reserve--nor would it be appropriate--to protect lenders and investors from the consequences of their financial decisions. But developments in financial markets can have broad economic effects felt by many outside the markets, and the Federal Reserve must take those effects into account when determining policy.

Retail sales were generally positive, with increases characterized as modest to moderate. However, several Districts described motor vehicle and furniture sales as slow. Manufacturing activity expanded across most Districts, with reports of softening demand for building materials and autos. The weakness in the housing market deepened across most Districts, with sales weak or declining and prices reported to be falling or flat. Most Districts reported a continuing contraction in the residential mortgage market. Commercial real estate activity was generally stable to expanding. Demand for business loans held steady or weakened, while consumer lending was mixed. Agricultural conditions varied widely across Districts, with several reporting damage to crops and pastures as a result of excessive heat and drought conditions. Activity in the energy and mining sectors remained positive in all of the Districts reporting on these sectors. Nearly every District reported at least modest increases in employment during the recent survey period. Most Districts characterized their wage increases as moderate or steady. Wage pressures were intense only in isolated professions in short supply. And most Districts reported little change in overall price pressures.

Retail sales were generally positive, with increases characterized as modest to moderate. However, several Districts described motor vehicle and furniture sales as slow.

Manufacturing activity expanded across most Districts, with reports of softening demand for building materials and autos.

The weakness in the housing market deepened across most Districts, with sales weak or declining and prices reported to be falling or flat. Most Districts reported a continuing contraction in the residential mortgage market. Commercial real estate activity was generally stable to expanding. Demand for business loans held steady or weakened, while consumer lending was mixed.

Nearly every District reported at least modest increases in employment during the recent survey period. Most Districts characterized their wage increases as moderate or steady. Wage pressures were intense only in isolated professions in short supply. And most Districts reported little change in overall price pressures.

Though some Districts described employment condition as tight, most reported that wage increases were moderate or steady. Wage pressures were intense only in isolated professions in short supply.

Most Districts reported little change in overall price pressures.

About 60% of subprime mortgages carry an adjustable rate, and $650 billion will reset at a higher interest rate in the next 16 months. Even without factoring in a recession, we estimate that the losses on bad subprime and alt-A paper could amount to about $200 billion over the 2007-2011 period (1.5% of today’s GDP). This compares with $153 billion (2.5% of 1990 GDP) in losses associated with the S&L meltdown in the late 1980s. Spread out over several years, such losses do not seem overwhelming on their own. However, it is the knock-on effects that are the larger risk to the economy, including a hit to consumer confidence and wealth, a curtailment of credit availability, and increased selling pressure in the housing market. Bottom Line: Fed rate cuts cannot solve the subprime mess, but can limit the negative impact on the economy.

Employment in the U.S. private sector grew by 38,000 in August, the weakest in four years, according to the ADP employment report released Wednesday.

The ADP report suggests nonfarm payrolls may have grown much slower than the 120,000 anticipated by economists. See Economic Calendar.

It was the second straight weak reading in the ADP index; July's reading was revised lower to 41,000 from 48,000 initially reported.

"A deceleration of employment may be under way," ADP said in a release.

U.S. commercial real estate prices may fall as much as 15 percent over the next year in the broadest decline since the 2001 recession as rising borrowing costs force property owners to accept less or postpone sales.

``People aren't willing to do deals right now,'' said Howard Michaels, the New York-based chairman of Carlton Advisory Services Inc., which has arranged financing for real estate purchases including the Lipstick Building in midtown Manhattan. ``The expectation is that prices will come down.''

Investors in July bought the fewest commercial properties since August 2006 and apartment building acquisitions were down 50 percent from June, data compiled by industry consultants at New York-based Real Capital Analytics Inc. show. Archstone-Smith Trust in August postponed its $13.5 billion sale to a group led by Tishman Speyer Properties LP until October. Mission West Properties Inc., the owner of commercial buildings in Silicon Valley, said on Aug. 13 that the company's $1.8 billion sale may fail after a bank withdrew funding.

Wheat prices piled on 30 cents a bushel within the first minutes of trading -- the maximum limit permitted by the Chicago Board of Trade -- and rose to an all-time high of $8.055 a bushel. Wheat has been trading in record territory for weeks amid worsening supply concerns. Poor weather ravaged crops in the U.S., Europe and the Black Sea region this year, and now conditions in the Southern Hemisphere as it enters the growing season don't seem much better. At the same time, high market prices haven't deterred global demand.