The pain from higher borrowing costs may be spreading as consumers and businesses follow investors in shying away from risk, increasing the odds of a recession.

``While there is no basis for predicting a recession right now, the risks have surely gone up,'' says former Treasury Secretary Lawrence Summers, now a professor at Harvard University in Cambridge, Massachusetts. ``The combination of softness in the housing sector, contractions in credit, increased uncertainty and volatility, and losses in wealth make the chances significantly greater now.''

Economists at JPMorgan Chase & Co., Lehman Brothers Holdings Inc. and Merrill Lynch & Co. are among those lowering economic forecasts as the rising cost of credit prolongs the worst housing recession in 16 years. Now, two areas of the economy that have held up well so far, jobs and consumer spending, no longer appear immune to the fallout.

This prediction has been making the rounds on the internet.

Because of the problems in the credit market, many economists have lowered their overall predictions for economic growth. This shouldn't surprise anyone.

In addition, the two emboldened areas above have shown some weakness.

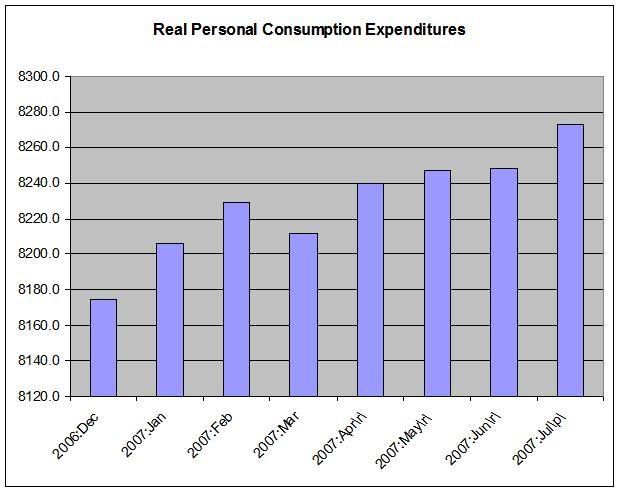

Here's a chart of personal consumption expenditures. The chart uses seasonally-adjusted annual rates in chained 2000 dollars. Notice we don't have a nice consistently upward sloping pattern. Instead, spending appears to have slowed over February to June of 2007. During this period gasoline prices were abnormally high. While gas prices have decreased since then, the consumer has faced two other issues that would crimp spending: a drop in stock prices which lower household net worth and the continued-fallout from the housing slowdown. Both of these have negatively impacted consumer confidence. Finally, the BEA lowered personal consumption expenditures to 1.4% growth in the latest GDP report. In summation, consumer spending as represented by the PCE expenditures from the BEA is an area of concern going forward.

Employment is a second area of concern. There are three areas to keep an eye on.

Construction Employment

Here is a chart from the BEA which shows construction employment since January 2001. Despite the drop in residential construction construction employment has barely dropped. There are two probable reasons for this.

1.) Non-residential construction has increased over the last year, absorbing lost residential jobs.

2.) Illegal labor's role in the construction area.

Financial services employment has shown continued advances over the last year. However, mortgage market problems started at the end of last year and show no sign of stopping. I wouldn't expect this employment sector to maintain the growth it has shown.

With the slowdown in consumer spending, retail employment has been stagnant for the last few months. A continued slowdown in consumer spending would obviously negatively impact this area of employment.

The short version is none of these areas is at a recessionary level yet. But both areas are clearly slowing in their rate of overall growth. In other words, we need to keep an eye on these levels going forward.