Import prices fell 1.1 percent in January and 23.4 percent over the past six months. For the sixth consecutive month, petroleum prices and nonpetroleum prices decreased, falling 2.4 percent and 0.8 percent, respectively, in January. However, prices for both overall imports and petroleum decreased at a smaller rate in January than in each of the previous five months since prices last rose in July. Petroleum prices fell 69.1 percent over the past six months and 55.0 percent over the past year, the largest 12-month decline since the index was first published in June 1982. Overall, import prices fell 12.5 percent for the year ended in January, the largest 12-month decline since the index was first published in September 1982. Nonpetroleum prices decreased 5.7 percent over the past six months and 0.6 percent over the past year.

The 0.8 percent January decrease in nonpetroleum prices was led by a 4.8 percent drop in the price index for nonpetroleum industrial supplies and materials. Falling prices for chemicals and natural gas were the largest contributors to the decline. Nonpetroleum industrial supplies and materials prices decreased 7.6 percent over the past year, led primarily by declining unfinished metals prices.

In contrast, prices for automotive vehicles increased in January, rising 0.2 percent after decreasing the previous two months. For the year ended in January, the index increased 0.7 percent.

The price indexes for consumer goods, capital goods, and foods, feeds, and beverages were unchanged in January. Over the past year, consumer goods prices increased 1.5 percent, capital goods prices advanced 0.9 percent, and prices for foods, feeds, and beverages rose 3.3 percent.

Looking at the BLS' end use tables we see drops in industrial supplies and goods but increases in capital goods, autos and consumer goods. However, all imports excluding fuels and all imports excluding petroleum have been decreasing for the last four months.

Non-manufactured articles dropped 45.9% year over year.

Manufactured articles dropped 3.7% year over year.

Here's the chart from Econoday:

From the BLS:

The Producer Price Index for Finished Goods rose 0.8 percent in January, seasonally adjusted, the Bureau of Labor Statistics of the U.S. Department of Labor reported today. This increase followed declines of 1.9 percent in December and 2.5 percent in November. At the earlier stages of processing, the decrease in prices for intermediate materials slowed to 0.7 percent from 4.2 percent in the prior month, and the index for crude materials declined 2.9 percent after dropping 5.3 percent in December.

What makes this news less scary is that core PPI has been increasing for the last five months when we've been seeing large decreases in the overall PPI. However, core prices of intermediate goods have been decreasing for the last four months and core prices of crude goods decreased throughout the fourth quarter of 2008 while ticking up slightly last month. In other words, there could be downward pressure on prices over the next few months.

Here are the relevant charts from Econoday:

From the BLS:

The Consumer Price Index for All Urban Consumers (CPI-U) increased 0.4 percent in January, before seasonal adjustment, the Bureau of Labor Statistics of the U.S. Department of Labor reported today. The January level of 211.143 (1982-84=100) was virtually unchanged from January 2008.

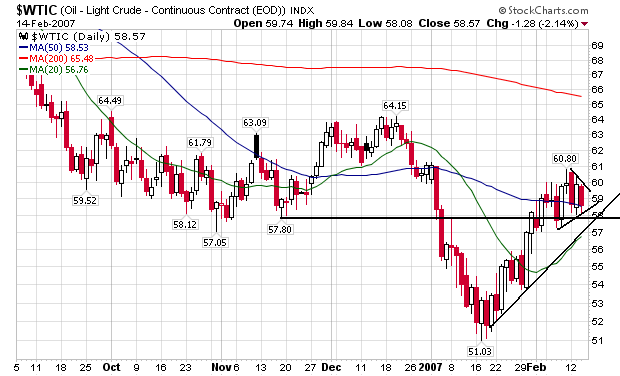

The good news here is core prices are still positive for the last 8 months. This tells us that price drops are occurring in the food/energy area rather than overall. A big reason for the drop in CPI over the last half of 2008 was transportation costs. Here is a chart of gas prices from that period:

In addition, although agricultural prices have dropped over the same period:

They have remained positive in the CPI numbers over the last half of 2008.