- by New Deal democrat

As usual, we start the month with reports on last month’s manufacturing, and construction from two months ago.

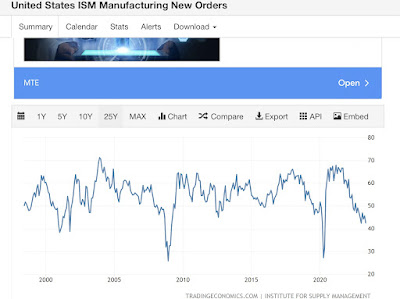

The ISM manufacturing index has a 75 year record of being a very reliable leading indicator. According to the ISM, readings below 48 are consistent with an oncoming recession. And there, the news is not good. Not only has the index been below 50 for the past 7 months, it has been below 48 for the past 6.

This month, the total index declined to 45.7, a new post-pandemic low. Perhaps even worse, the new orders subindex, which is the most accurately leading component, and which has been in contraction since last summer, declined to 42.6, just 0.1 above its post-pandemic low:

This is recessionary, plain and simple. The one caveat in this case is that the narrow but very important sector of manufacturing which is not partipating in this downturn is motor vehicle manufacturing, where supply shortages are still being resolved.

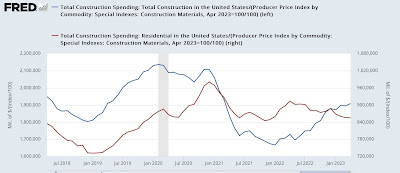

Now let’s turn to construction spending, which told a completely opposite story. Total construction spending rose 1.2% in April, and the leading component of residential construction spending rose 1.3%:

For the past several years, I have been adjusting the nominal numbers by the PPI for construction materials. This had been declining, but have been rising all this year, and rose another 0.5% in April. So adjusted, total real construction spending did increase, but residential construction spending declined slightly:

This was a very mixed start to the month, with an intensified decline in manufacturing, but yet another sign of a bottom in residential construction.