- by New Deal democrat

It is always a bad idea simply to project a current trend forward, especially with data series that are noisy and heavily revised. That was certainly on display with the April JOLTS report.

For the last several years, the jobs market has been a game of “reverse musical chairs,” where there are always more chairs than participants. Those employers whose chairs weren’t filled had to increase their wage and/or benefits offerings, or go without. This was good for labor, but certainly put pressure on prices as well.

Because the jobs market has remained so strong, it has been unlikely that a recession would start unless the situation with job openings returned to at least close to its pre-pandemic levels. Only then could there be enough layoffs to actually be consistent with a negative monthly jobs number.

Last month, there were steep declines in job openings and hires also declined significantly. This morning’s report reversed some of those dynamics, while the overall trend of deceleration remained intact.

Last month, there were steep declines in job openings and hires also declined significantly. This morning’s report reversed some of those dynamics, while the overall trend of deceleration remained intact.

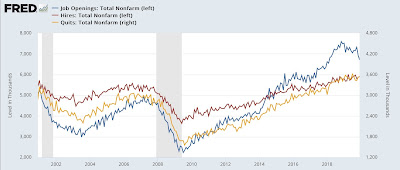

Job openings (blue in the graphs below) rose 353,000 (from a March number revised higher) to 10.013 million annualized (from a peak of 12.027 million in March 2022, vs. 7 million just before the pandemic), and actual hires (red) rose 47,000 from a downwardly revised March to 6.115 million (vs. a peak of 6.843 million in November 2021 and 6 million just before the pandemic). Voluntary quits (gold) declined -49,000 to 3.793 million (vs. a peak of 4.501 million in November 2021 and 3.5 million just before the pandemic:

All of the above remained close to 2 year lows.

Here is the longer term view of all 3 metrics from the series inception, better to show the current situation with the historical one before the pandemic hit:

Here is the longer term view of all 3 metrics from the series inception, better to show the current situation with the historical one before the pandemic hit:

All three remain at levels higher than at any time before the pandemic hit.

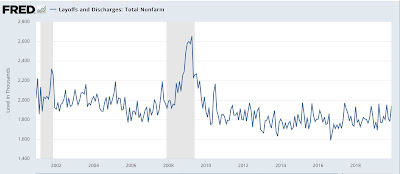

Contrarily, layoffs and discharges decreased -264,000 to 1.581 million annualized, reversing last month’s big increase:

But even so, April’s number remains well above the average for the past 2 years.

Here is the longer term historical record for layoffs showing how, before the pandemic, the current level would be extremely low:

There are two overarching trends in this data:

(1) the absolute fundamentals for labor remain quite positive,

(2) but they continue to decelerate.

All of the above remains consistent with a very positive jobs report this coming Friday, but continuing to show deceleration compared with the last 12 months.