Tuesday, November 6, 2012

Morning Market Analysis

Oil continues to move downward, albeit slightly. Notice the bearish orientation of the EMAs -- the shorter are below the longer and all are moving lower. Prices are also below all the EMAs. Finally, we have decreasing momentum and a slightly negative CMF reading.

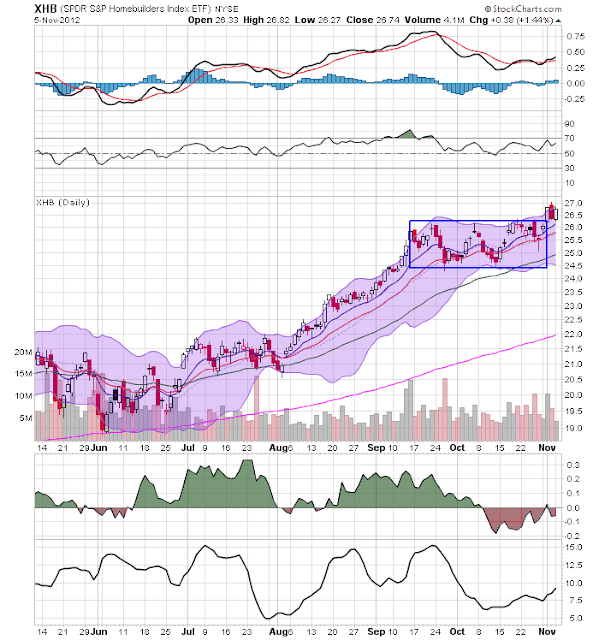

After breaking through resistance, both semi-conductors (top chart) and homebuilders (bottom chart) have consolidated gains. The big key for the semi chart is to get above the 200 day EMA.

On the daily chart (top chart) notice the German market broke trend in early September and has since been trading sideways, remaining above key support -- which is just about the 22 handle. On the weekly chart (lower chart) notice that upward momentum stalled at the 61.8% Fib level. A move above this level shows there's a lot of daylight for a rally.