- by New Deal democrat

One of the running themes in my long term outlook since the Great Recession has been that the American economy is in a race between debt deleveraging by households, and wage stagnation leading to outright wage deflation. If households deleverage in time, they will be able to safely spend more, with increasing demand will come increasing jobs, and real wages can stabilize at a rate of growth comfortably above zero. On the other hand, if wage deflation strikes before households are fully deleveraged, then we are very much in a scenario similar to if not the same magnitude as the 1929-32 vicious cycle.

At this point, the odds are increasingly favoring deflation winning out.

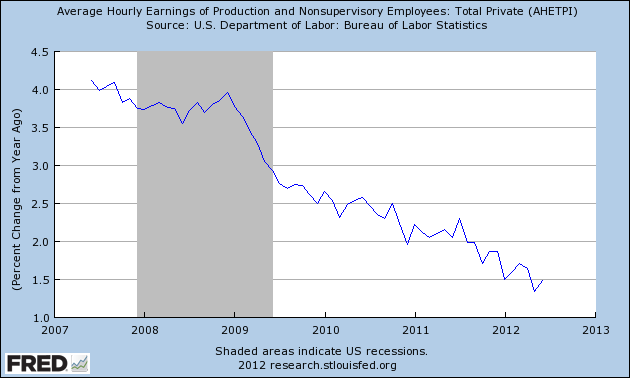

Here is an updated graph, through June, of average hourly earnings measured YoY:

Even during the Great Recession, with wages growing at a nominal annual rate of 3%, there was room for real wages to grow if the inflation rate was 1% or even 2%. At 1.5%, we are running out of room. Even a YoY inflation rate of 2% is too much for households. If this trend holds, we have no more than 24 months before actual wage deflation is upon us -- and remember, mean wage growth has been higher than median wage growth, which unfortunately is only reported quarterly.

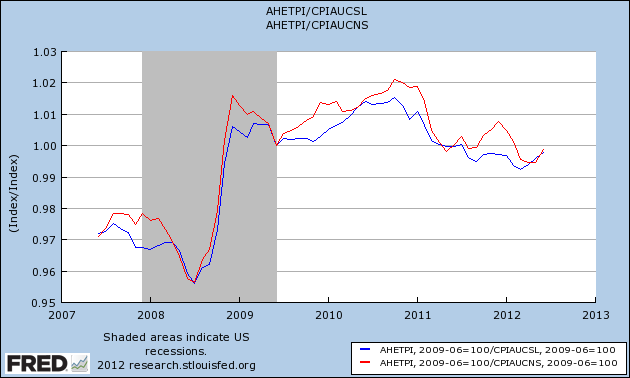

Here is what is happening with real wages, i.e., wages deflated by the CPI, both seasonally adjusted (blue) and non-seasonally adjusted (red):

On a seasonal basis, inflation tends to accelerate in the early months of the year, and become quiescent later in the year. This probably is a large part of the explanation as to why recently the economy seems to grow more at the end of the year, and then slow down in the first half of the next year.

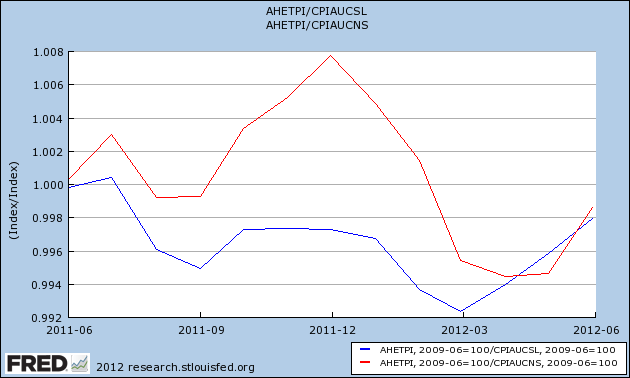

Here's a close-up of the same information for the last year:

Note the 1.3% decrease in real wages between December of last year and April of this year.

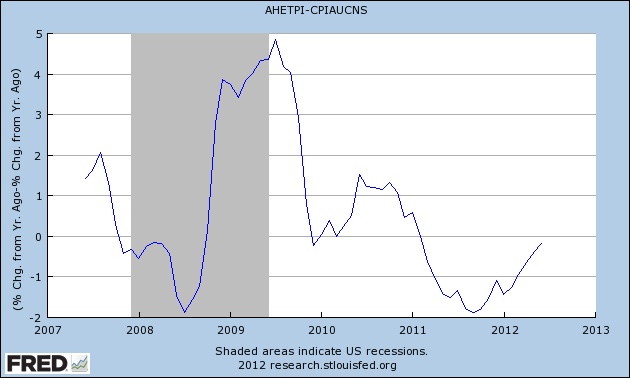

Now here's the YoY% change in real wages:

Notice that on a YoY basis, real wages declined nearly 2% in late 2011, as bad a relationship as during the middle of the Great Recession. As of June of this year, this has nearly totally abated, as wages are only down about 0.2% YoY. With any luck, this will turn positive this month or in August. If the ongoing tension with Iran does not cause another spike in gas prices, this should temporarily ease the strain on consumers.

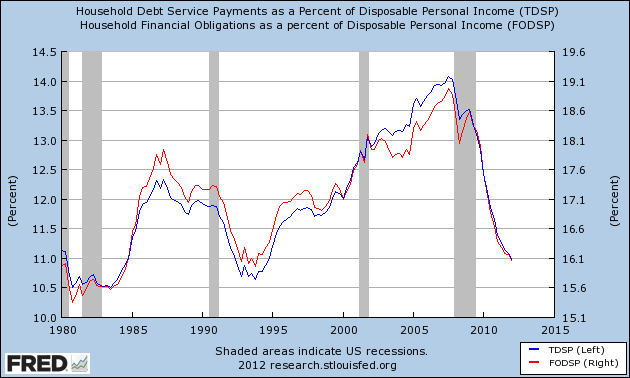

To complete the picture, here is the latest information (through the first quarter) on household deleveraging. This looks encouraging until you know that in each of the last two quarters, revisions to past data have completely wiped away any continuing progress in deleveraging. In other words, the levels of debt now are almost exactly what they were initially reported to be in the third quarter of 2011:

The chances that household deleveraging will reach new series lows sufficiently before 24 months from now so as to generate robust and safe new consumer spending by then appear increasingly remote.

If that's the case, then wage deflation is going to win the race.