If you would like to donate for Japan relief, here is a link to the Red Cross..

The Federal Reserve's report on household debt burdens was released yesterday, covering the October - December quarter of 2010. According to the bank,

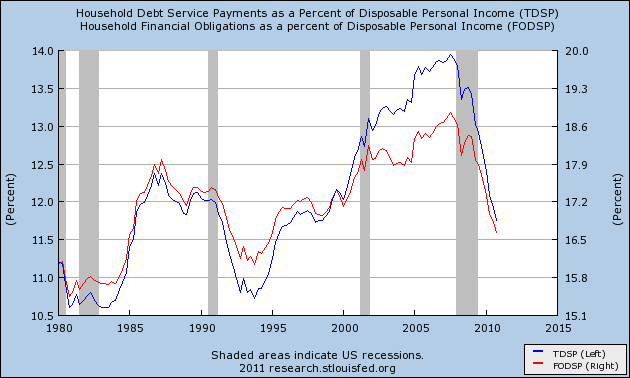

The household debt service ratio (DSR) is an estimate of the ratio of debt payments to disposable personal income. Debt payments consist of the estimated required payments on outstanding mortgage and consumer debt.Both measures declined substantially again, although by not as much as during most of last year. I've combined them into a single graph:

The financial obligations ratio (FOR) adds automobile lease payments, rental payments on tenant-occupied property, homeowners' insurance, and property tax payments to the debt service ratio.

Debt service payments (blue line, left scale) are now less than about 2/3's of the last 30 years. Total financial obligations (red line, right scale), are now less than almost 3/4's of the last 30 years -- all but the early 1980s and a few years in the early 1990s.

If this rate of decline continues, then by the end of this year, both of these will be at or very close to their all time lows.

As I have pointed out previously, a lot of this reflects refinancing debt obligations at lower rates -- which is why the overall debt owed by American households has not contracted nearly so much as the percent of disposable income needed to pay it.

In the longer term, this is good for households, and good for a sustainable economic expansion.