Last year I identified 7 "harbingers of the summer slowdown" -- seven data series that turned ahead of the general downdraft that commenced very quickly in late April and early May. They were:

- Libor index rising

- Shanghai stock index selloff

- Bond yields correlation with stock prices

- Price growth exceeded wage growth

- Real M1 and M2 money supply stagnant or shrinking

- Decline in housing permits and purchase mortgage applications

- Oil prices at 4% of GDP

All of these were already in place when the Gulf oil disaster, the Euro crisis, the flash crash, and the expiration of the housing credit all took place within a few weeks of each other.

We know that Oil is once again at or even above 4% of GDP, but how are all of the harbingers doing?

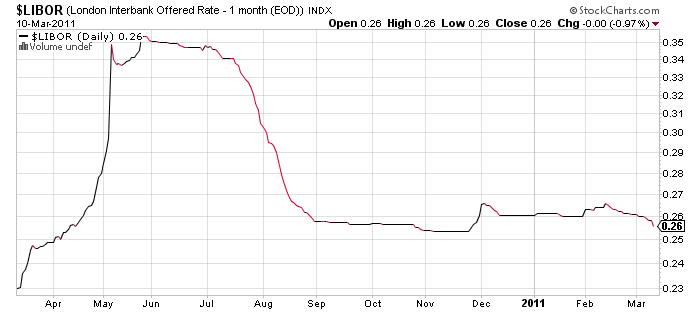

1. LIBOR is unconcerned.

This is the London InterBank Overnight Rate, and serves as a measure of stress in the banking system. It went off the charts, so to speak, at the time of the 2008 crash. As you can see in the below graph, it spiked as the Euro crisis last spring continued to worsen. Now, despite the continuing trouble with Europe's "PIIGS", it is somnolent:

2. Soft selloff in Shanghai

The Shanghai stock market was the most leading stock market in the world going into and coming out of the 2008 crisis. It turned down again at the end of 2009. Significantly, it has failed to make a new high since, but the selloff was muted compared with last year, and an uptrend has resumed:

3. Stocks and bonds have turned down together as they did a year ago.

When stocks are more concerned about deflation than inflation, they move in lockstep with bonds - unlike the 1982-98 period when they moved as mirror images of one another. The last few months have seen bond yields top out and move lower, followed shortly thereafter by stocks -- just as in early last year:

4. Price growth is approaching wage growth - but hasn't overtaken it yet.

The below graph shows the inflation rate (blue) vs. the median YoY% of wage growth (red), vs. mean wage growth (green). The median is the more important measure, but is only updated quarterly, whereas the mean is updated monthly. While this hasn't turned negative yet, if the current trends of inflation vs. wages continue, it will be negative again by May:

5. Real M1 and M2 are improving.

Last year the rate of growth in M1 had declined steeply, and real M2 (but NOT real M1) had declined to the point that in the past had been consistent with recessions. Now both are generally in an uptrend. Real M1 is vigorously positive, and real M2 has been meandering around the "all-clear zone" for the last month:

6. Housing starts and mortgage applications are generally flat, but are not decreasing:

Housing strats declined dramatically last spring with the expiration of the housing credit. They have fluctuated, but have not declined further since that time:

Similarly, purchase mortgage applications declined steeply with the expiration of the housing credit. They have leveled off since last July:

7. Oil is crossing the danger threshold.

This is something we already knew. Note that the below graph is monthly, and does not show the surge in the price of OIl in the last few weeks:

In summary, comparing this year with last year, we can say the following:

1. finanical conditions, i.e., LIBOR and money supply, are not in the stress they were in last year.

2. global growth, especially in leading Asia, has not been derailed.

3. housing starts and purchases are stable rather than turning down.

But:

4. Oil has crossed an important threshold.

5. As a result, bonds and stocks are beginning to worry about a curtailment in demand, which means deflation in a few months.

6. In the meantime, energy prices are causing inflation to overtake wages.

As has been noted before, "the cure for high oil prices is - high oil prices." A slowdown seems baked into the cake, but not one as significant as last year - so far. Needless to say, now would be a particularly poor time for Austerian government stupidity.