Click for a larger image

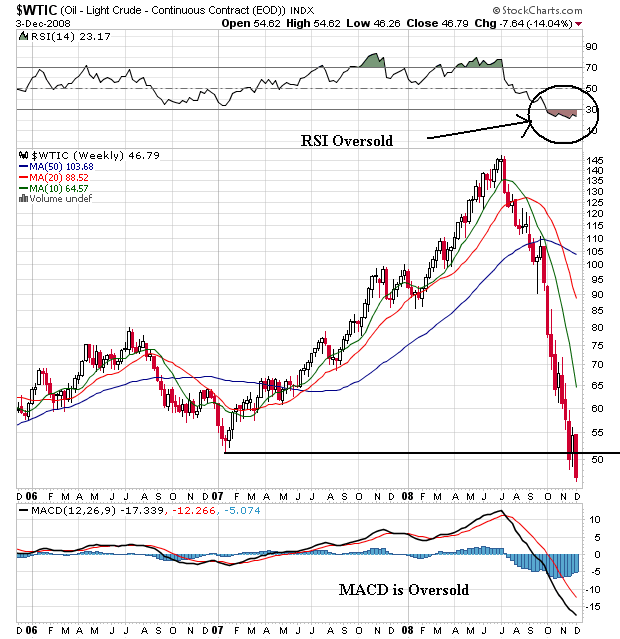

Notice the following on the weekly chart:

-- Prices are at their lowest point in three years

-- Prices have dropped 67% from their high five months ago

-- All the SMAs are moving lower

-- The shorter SMAs are below the longer SMAs

-- Prices are below all the SMAs

BUT

-- The RSI is very oversold

-- The MACD is oversold

Click for a larger image

Notice the following on the daily chart

-- Prices have been dropping for the last 5 months

-- All the SMAs are moving lower

-- The shorter SMAs are below the longer SMAs

-- Prices are below all the SMAs

BUT:

-- The MACD has been rising for about a month

Bottom line: There are technical indicators that say the market should rally. Like all indicators these should be read against the fundamental background of everybody selling their contracts and demand dropping.