Information contained within the Minneapolis Fed's report casts doubts on the claims they make. First, they rely on the fact that there has been no decrease in lending. They look at total bank credit outstanding, total loans and leases, total commercial and industrial loans, and total consumer loans and conclude "we see no evidence of any decline during the financial crisis." Before we take their conclusions as golden, let's consider the economic landscape of the last year. According to the NBER the US was in a recession which started in December 2007 - a year ago. In other words, it should not be surprising there was not an increase in lending. In fact, a careful reading of each Beige Book from the last year along with a reading of the Federal Reserve's survey of senior loan officers indicates a drop in loan demand along with a tightening of lending standards throughout the year.

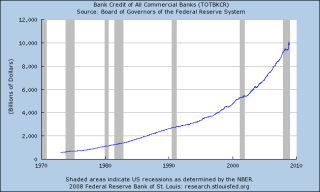

More importantly, let's look at total US credit outstanding going back to the early 1970s.

What does this chart tell us? There are two important facts.

1.) The latest recession is the only recession where total credit outstanding has leveled off for an extended period. (The first recession in the 1980s saw a contraction but only after total credit increased). While it didn't decrease it also didn't increase. Compare this to the previous 6 recessions when lending increased at least slightly throughout the recession. In other words, the leveling off of credit creation is a story in and of itself.

2.) In order for the US economy to grow it must have a continual supply of new credit. A leveling off is just as hazardous as a decline.

And that is what happened during most of 2008. The graphs contained within the Minneapolis Federal Reserve report show a clear leveling off of total outstanding credit for most of 2008. Again - this is the only recession in the last 40 years where this has happened.

Secondly, the Minneapolis Fed relies on the spread of various bonds to the Treasury curve. This will take several steps to explain.

Step 1: A bond's price and yield are inversely related. As bond prices go up, the bond's yield goes down. As a bond's price goes down, its yield goes up.

Step 2: The yield on various bonds and assets are compared to the Treasury curve to measure "risk". People assume that US Treasury Bonds are the safest investments in the world. Therefore, comparing the interest rate on various assets to the comparable Treasury (the Treasury with the same maturity) will tell us how risky that asset is.

Step 3: Inflation eats away at fixed income investments. As a result, when investors think inflation will decrease they are more likely to buy Treasury bonds because there is less chance the income received will fall because of higher inflation.

Here's an example. Suppose a 10 year Treasury bond was yielding 5% and a 10 year corporate bond was yielding 7%. The "spread" would be 2% or 200 basis points. This is the difference between the yield on the Treasury bond and the corporate bond. Suppose another corporate bond was yielding 8%. This spread would by 3% or 300 basis points. These facts tell us the market things the second corporate bond is riskier because it yields more than the comparable Treasury and a corporate bond with the same maturity.

Let's take all of this and apply it to the Minneapolis Fed's report. They notice that

While the rationale [for using spread analysis] may be compelling in normal times, we think that a focus on spreads can lead to misleading inferences during financial crises. Financial crises are often accompanied by a flight to quality during which the real return to Treasury securities falls dramatically, that is, the nominal return falls dramatically for reasons other than changes in expected inflation.

Over the last few months we've seen a huge rally in Treasuries. In fact, some people have argued the Treasury market is in a bubble. As a result, the yield on Treasuries is really low. But this is not caused by inflation expectations; that is, people are not buying Treasuries because they think inflation is low. They are buying Treasuries because they are concerned about investment safety.

What the Minneapolis Fed report fails to take into account is inflation in one reason for invetors to purchase Treasury bonds. Another is safety. Because US Treasury bonds are considered the safest in the world people are buying them at a high rate meaning Treasuries are yielding an incredibly low rate right now. Some T-Bills have recently been issued at 0% interest! That in and of itself tells us the level of concern is abnormally high and a credit crunch is indeed going on - people don't' want any return; they simply want their money bank!

In short, inflation expectations are one reason why people buy Treasury bonds. But another very important reason is safety. And investors are clearly concerned mostly with safety right now if they don't even want a return on their investment.

The Bank of Boston adds other extremely credible explanations for the lack of decline in lending. They note that in a credit crunch companies rely more on their existing lines of credit as other sources of funds (the stock market, commercial paper and new lines of credit) dry up. In addition, banks are unable to securitize loans in the current environment and are therefore forced to keep more loans on their books, thereby increasing lending. The paper also shows that lower grade corporate issuers (single A) have seriously cut back on their commercial paper issuance, indicating that only the very best credit quality issuers are able to obtain short-term funding in the commercial paper market.

From a personal level -- and purely anecdotal -- I work with several business brokers in the Houston area. Over the last 6 months when we have seen is a tightening of credit which has caused an increasing number of deals to fall through.

The point of all this is simple: the facts within the Minneapolis Fed's paper directly contradict the Fed's conclusions. In addition, the Boston Fed's paper adds more credible evidence that a credit crunch is indeed ongoing. I would add that a thorough review of the anecdotal evidence in the Federal Reserve's Beige Book and Senior Loan Survey shows lending standards have been tightening for a year and loan demand has been dropping.

But more to the point: why is this debate occurring? What are we talking about whether or nor there is a credit crunch? There are two reasons.

First, the Treasury has mishandled the TARP from the very beginning. First Paulson wanted unfettered power to do whatever he wanted to with the funds without and Congressional or judicial review. Then he came up with the $700 billion number out of thin air. Next he wanted to buy troubled assets only to change his mind to injecting money directly into the banks. And then the GAO released a report stating there was no oversight of any of this. Simply put, the program's creation, implementation and supervision are all a disaster.

Secondly, there is a very strong anti-Wall Street mood right now. Some of this is deserved. We got into this mess because Wall Street wanted deregulation only to act poorly when there were no rules. However, not everyone who works on Wall Street is a relative of Satan. And simply because you are involved with investment banking or investments in general does not mean you are evil. I know several brokers who have offered their clients excellent advice over the last year - advice which has lead to lower commissions for them. And they are not alone. The point is painting any group of people with a broad brush is a bad idea.