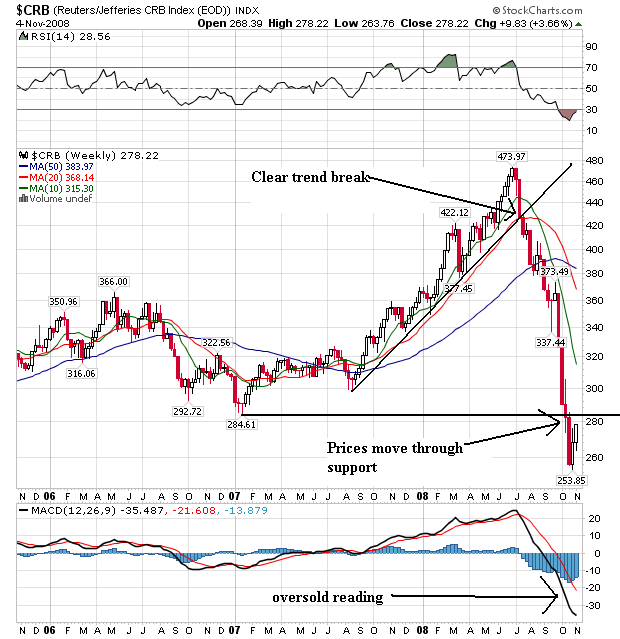

Notice the following on the weekly chart:

-- Prices clearly broke through the uptrend started in mid-2007

-- Prices are below all the SMAs

-- The 10 and 20 week SMAs have moved through the 50 week SMA

-- All the SMAs are moving lower

-- The shorter SMAs are now below the longer SMAs

-- Prices moved through support established in early 2007

-- Technically the market is oversold at this level.

Bottom line: this is a bearish chart.

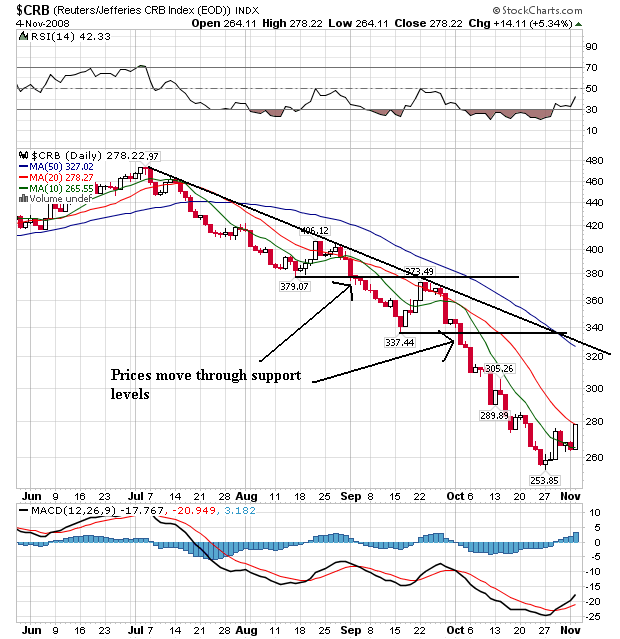

Notice the following on the daily chart:

-- Prices have been dropping for three months

-- All the SMAs are moving lower

-- The shorter SMAS are below the longer SMAs

BUT

-- The market is technically oversold right now and

-- Prices have moved through the 10 day SMA and are meeting resistance at the 20 day SMA

In other words, this could be a reversal point. However we would need to see a convincing move beyond the 20 day SMA to say for sure.