Subprime mortgage defaults will increase this year and holders of securities linked to those home loans may experiences losses well into 2008, JPMorgan Chase & Co. analysts said.

``The worst is not over in the subprime mortgage market,'' analysts led by Chris Flanagan, the head of structured finance strategy, said in a report today. ``We expect continued deterioration in subprime loan performance through the balance of this year, and it is likely to be well into 2008 before the problems in securitized portfolios begin to abate.''

Home price declines will lead to ``substantial increases in subprime mortgage defaults and losses,'' Flanagan, who is based in New York, said in a report titled ``Subprime Meltdown, the Repricing of Credit and the Impact Across Asset Classes.'' Borrowers of as much as 50 percent of the $500 billion of mortgages that will reset in the next 18 months may not be able to refinance, Flanagan estimates.

Mortgages defaults at 10-year highs have reduced prices of some bonds backed by home loans to people with poor or limited credit by more than 50 cents on the dollar. The increased risk of default prompted Moody's Investors Service, Standard & Poor's and Fitch Ratings to begin cutting credit ratings on hundreds of bonds last week.

Nobody should be surprised by this. The Fed's most recent Monetary Report to Congress stated:

Delinquency rates on subprime mortgages with variable interest rates -- which account for about 9% of all first lien mortgages outstanding, continued to climb in the first five months of 2007 and reached a level more than double the recent low for this series, which was recorded in mid-2005.

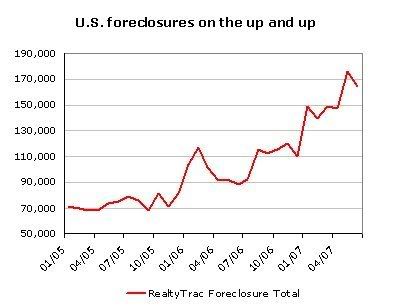

Here's a chart of the result -- an increase in foreclosures from the blog Interest Rate Roundup

And don't expect this stop in the near future. One of the reasons for the financials poor performance (see post just below) is concern over foreclosures and an increase in loan loss reserves at financial institutions.