World oil and gas supplies from conventional sources are unlikely to keep up with rising global demand over the next 25 years, the U.S. petroleum industry says in a draft report of a study commissioned by the government.

In the draft report, oil-industry leaders acknowledge the world will need to develop all the supplemental sources of energy it can -- ranging from biofuels to nuclear power to oil extracted by unconventional means from the oil sands of Canada -- to meet soaring demand. The surge in demand is expected to arise from rapid economic growth in such fast-developing countries as China and India, as well as mounting consumption in the U.S., the world's biggest energy market.

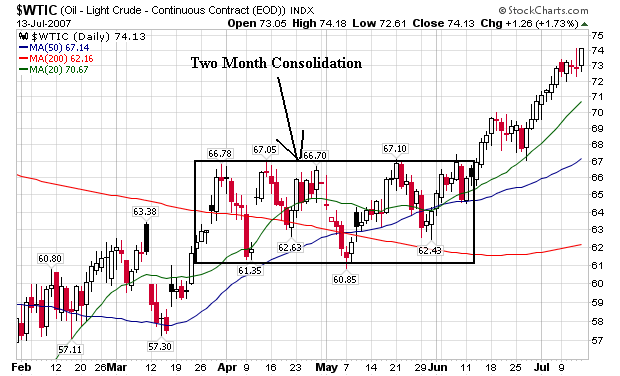

This is a good time to look at the daily and weekly oil charts to see how they are performing.

Here's the daily chart. Notice that prices consolidated for about two months between $61 and $67. As a rule of thumb, when prices move within a roughly 10% range, it's usually a consolidation pattern where traders are either selling old positions and taking profits or buying new positions and betting on higher prices. Because oil prices typically increase during the summer, traders were buying contracts in April and May betting on a summer rally.

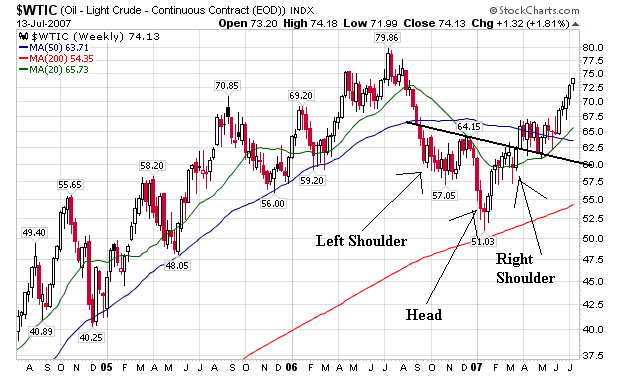

From the weekly perspective, we have prices bottoming in a classic head and shoulders formation and rallying from that base.

From both a daily and weekly perspective we have a strong reason to expect the rally to continue and for prices to remain high. From the daily perspective we have a solid two month base. From the weekly chart we have a classic reversal.

From the fundamental perspective we have India and China growing at high rates creating an additional 2 billion people demanding energy. Increased demand = higher prices.

In addition, there is the peak oil argument which states oil supplies are already at or near their highest levels and will only decrease from here. I can't speak to the veracity of that claim, but if it's true then we have a big problem on our hands.