According to Stockcharts.com's performance function, the best performing iindustries last week were the XLP's (consumer staples), up 2.47% and the XLV's (Health care) up 1.8%. The next best performing sector was the financial (XLF), up 1.23%. This was a technical bounce. I don't see this sector rallying with all of the problems they are having. The point here is traders are shifting assets to conservative market sectors.

In addition, the basic materials sector (XLB) and the energy sector (XLE) which were the best performing sectors over the last year have been losing value over the 90 day, 30 day, 10 day and weekly horizon. My guess here is traders are taking year end profits to lock in performance gains.

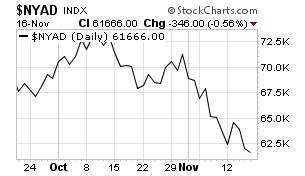

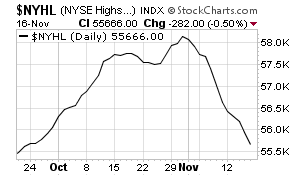

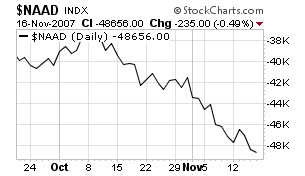

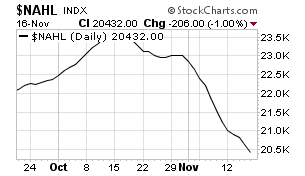

And market breadth continues to deteriorate across the board.

New York advance/decline line

New York new high/new low line

NASDAQ advance/decline line

NASDAQ new high/new low line

Notice the money flowing into conservative stocks

Coke

P&G

Johnson and Johnson

And notice how the high fliers are still consolidating below previous highs.

Bidu

Apple

Dry Ships

Edu