But are there investment opportunities amid the wreckage? Some investors think so. They're diving right in and gobbling up shares of the financial houses at the center of the maelstrom, including Bank of America (BAC), Citigroup, American International Group (AIG), JPMorgan Chase (JPM), Merrill Lynch, and Morgan Stanley (MS). "We are buying them all," says David Katz, chief investment officer at Matrix Asset Management, a New York money management firm with assets of $1.6 billion.

Are Katz and other money managers playing with fire? There certainly are risks. But the rewards to confronting the risks look compelling, given the financial firms' steep fall. As of Nov. 19, Citigroup is down to $32.50 a share from its 52-week high of $57 on Dec. 28, 2006. Bank of America is at $43.15, down from $55.08 on Nov. 20, 2006. AIG is at $55, down from $72.97 on May 11. JPMorgan is at $42, off from its high of $53.25 on May 9. Merrill Lynch tumbled to $53.50, from $98.68 on Jan. 18. And Morgan Stanley dropped to $51.16 from $75.50 on June 15.

The Case for Buying

The argument for buying is not that these companies won't have more problems. Perhaps some of them will. But Katz and others believe that, as a group, these giant finance companies play such a central role in the economy that they'll continue to have bright prospects. "We aren't playing with fire, because these companies are the biggest and the best players in finance and investments, with tremendous, diverse resources and clean balance sheets," says Katz.

I've been making a great deal of fun of this philosophy, and frankly will continue to do so. This is stupid beyond belief. Anybody who us making this move is making a classic investment mistake. They are assuming that:

1.) Because something is cheap relative to a another price at a certain time it is time to buy something,

2.) There is only so far a large stock can fall, and

3.) There won't be anymore major damage to the financial section of the market.

Let's rebut these argument one at a time.

1.) Because something is cheap relative to a another price at a certain time it is time to buy something:

There are two kinds of cheap. The first kind is an undiscovered gem -- a company who's book value is higher than it's stock value. This is classic "value investing" (for more on this, read the Graham and Dodd book Securities Analysis.) This is not what we're talking about here.

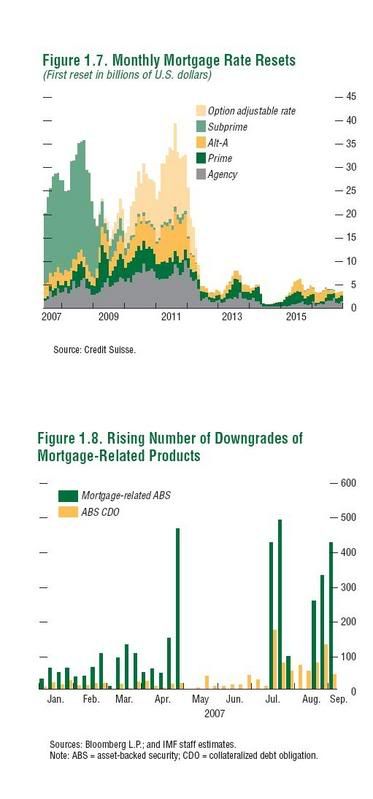

What we are talking about with financial stocks are securities which are cheap because they are crap. There have been over $50 billion in writedowns over the last quarter. And we're just getting started. Take a look at this chart from the IMF:

There are three more years of resets out there. Do you really think this is the only quarter when we're going to have writedowns?

The above chart is the reason these companies are cheap because they're crap.

2.) There is only so far a large stock can fall,

Right. A great company -- or a necessary company -- won't go below value x because it's so necessary too the economy. Take a look at (Fannie Mae) FNM or (Freddie Mac) FRE and ask yourself if that proposition still holds up.

3.) There won't be anymore major damage to the financial section of the market.

See the chart above. There is a ton of crap out there in financial-land. We don't know who owns how much of what -- and we won't know for some time. Companies are doing everything they can to not tell us, holding onto the pipe dream that somehow this whole mess will turn around.

So -- if anyone is telling you financial stocks are a great buy right now show them the door. The only good thing about financial stocks is they are great targets for shorting. That's it.