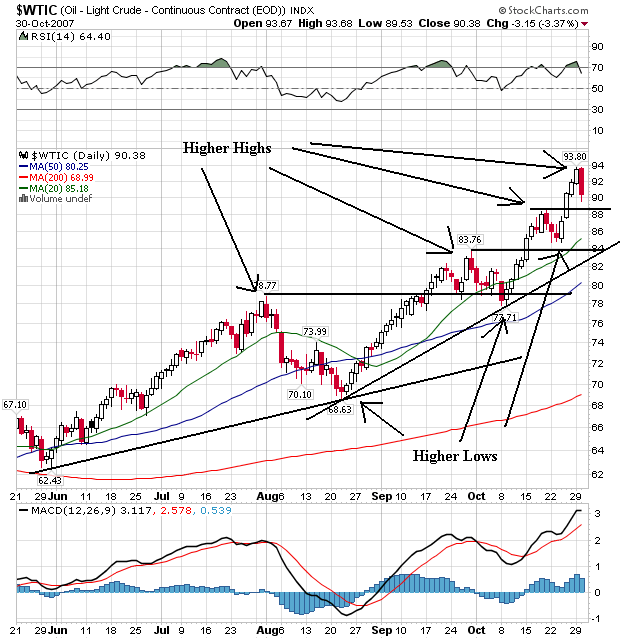

This is a great example of a bull market chart. Notice the following.

1.) A series of higher highs and higher lows.

2.) The shorter simple moving averages (SMAs) are higher than the longer SMAs.

3.) All the SMAs are moving higher. That means the short (2 month), medium (2 1/2 month) and long term (40 week) trend is positive.

4.) Notice how prices have moved through previous highs over the last few months. These previous price levels also provide a ton of technical support when prices are decreasing, making it more difficult for prices to move lower.

5.) Although two technical indicators are at or near overbought levels (the RSI and MACD) that does not mean prices are going to drop. Notice from mid-September to mid-October that prices were also overbought and prices simply consolidated above previous highs. Overbought technical conditions can just as often lead to consolidation as a drop in bull markets.

6.) There are two upward sloping trend lines in place.

Today's WSJ has an article on the oil market that seems to inherently admit the "peak oil" argument. This argument states (essentially) that most or all of the world's oil has already been found and the world is at or near the highest level of oil production we'll see. Because I'm not a petroleum guy I can't speak to the veracity of these arguments (which isn't to say they aren't true). However, for more information, go to the Oil Drum website for some really good discussion on the matter.

From the WSJ article:

Several leading oil experts, gathered here yesterday for an annual energy conference, sketched a near-term future in which mounting global demand and shrinking supplies push oil prices well past the $100-a-barrel mark.

Consuming countries, they argued, will simply have to deal with the fact that new pockets of oil are getting far harder and more expensive to tap. That, combined with years of underinvestment by the industry, has led to a tapering off of new oil supplies that will continue for years, despite rising energy demand in Asia, the Middle East and some industrialized countries.

....

Sadad I. Al-Husseini, an oil consultant and former executive at Aramco, Saudi Arabia's national oil company, gave a particularly chilling assessment of the world's oil outlook. The major oil-producing nations, he said, are inflating their oil reserves by as much as 300 billion barrels. These amount to hypothetical reserves that are "not delineated, not accessible and not available for production."

A lot of production in the Middle East is from mature reservoirs, and the giant fields of the Persian Gulf region, he said, are 41% depleted.

Global oil and gas capacity is constrained by mature reservoirs and is facing a "15-year production plateau," Mr. Husseini said. He predicted that supply shortages will continue to add $12 to the price of oil for every million barrels a day in additional demand. Global demand, now at some 85 million barrels a day, was on average 10 million barrels a day lower in 1999.

.....

Andrew Gould, the chairman and chief executive of Schlumberger Ltd., an oil-services company, expressed similar concerns, noting that 70% of the oil fields that now quench world demand are more than 30 years old. The growth in global demand since 2003, he said, has been roughly the equivalent of the daily output from two of the world's larger suppliers: the North Sea and Mexico.