Countrywide Financial Corp. cheered investors last week by pledging a quick return to profitability, boosting the stock price that day 32%.

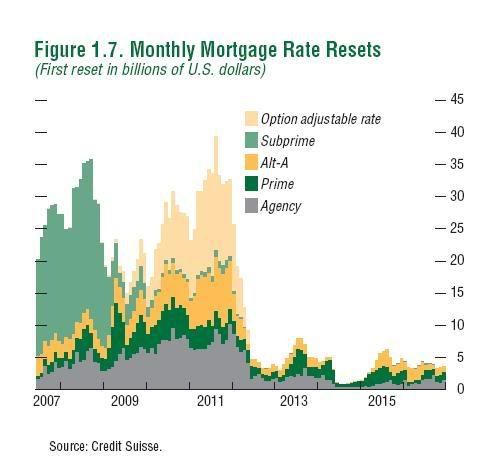

Consider the following chart from the IMF:

Also add this from IBD:

ABX indexes, barometers of demand for mortgage-backed securities, have plunged again in recent weeks. They range from the highest-rated AAA slice of mortgage debt to the riskiest tranches, rated BBB-.

The BBB- tranche from the second half of 2006 was worth just 17.94 cents on the dollar Monday, according to Markit.com. Some tranches eventually may prove worthless.

"It's probably not a straight shot to zero but it's close enough for me to stay fully invested," Lahde said.

....

Subprime loans from late 2006 are the worst of the worst. Lenders, desperate to keep loan origination strong, loosened their already-lax credit standards. Home prices were at or near their peaks. So these loans started going bad almost as soon as they were made — well before any interest rate resets.

Foreclosure filings doubled in September from a year ago. They are set to rise even further, dumping more homes on an already bloated market.

A record 17.9 million homes stood empty in the third quarter. It could get worse.

Does it look like a financial company that is heavily invested in the real estate market is going to bounce back from problems quickly?