"The Fed is caught right now. The inflation numbers are looking worse, but on the other hand, the economy is looking softer," said David Wyss, chief economist at Standard & Poor's in New York.

Wyss said he believed the Fed was using the statement to edge closer to cutting rates if necessary to bolster economic growth, but he said investors should not expect any change at the Fed's next meeting on May 9.

David Jones, chief economist at DMJ Advisors, a private consulting firm, said he believed the Fed would remain on hold probably until September.

"The Fed is facing a standoff. The economy is slowing and inflation is getting worse," Jones said. "They have got to let the dust settle on this very mixed picture before they do anything."

Wyss said the Fed could cut rates as many as three times although he said some of those reductions might not come until next year.

Jones said he believed the Fed might be content to just cut rates once in the second half of this year if the economy is showing signs of rebounding at that time.

Let's look at the overall numbers.

GDP growth has been "below full potential". It grew at a pace of 2%, 2.6% and 2.2% in the second - fourth quarter of 2006, respectively. Housing has the big reason as it decreased 11%, 19% and 19% in the same quarters.

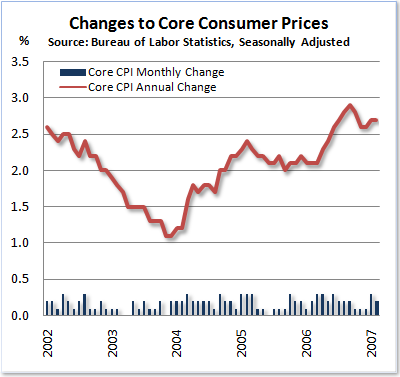

At the same time, inflation has increased. Here's a year-over-year chart of core CPI:

Yesterday the markets were just thrilled about the possibility of a rate cut. But they forgot about inflation. Assuming all things remain the same, the Fed won't be lowering rates anytime soon.

Right now it sucks to be a Central Banker.