- by New Deal democrat

The bad economic news this morning was that after taking into account inflation, retail sales, which rose 0.6% nominally, were only up 0.2%, and last month’s number, which I described as making a “face-plant,” was revised down a further -0.3% to -1.1%.

In other words, the net result was that real retails sales were -0.1% worse than last month’s poor result as initially reported.

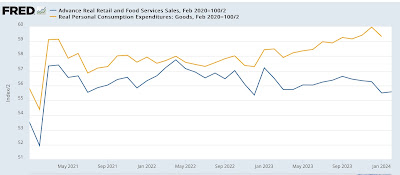

Which is bad enough. But it means that the last two months are the worst post-pandemic numbers in almost three years. Below I show them in comparison with real personal consumption on goods, the similar metric from the personal income and spending report, normed to 100 as of just before the pandemic:

I included the second number above because real retail sales and real personal spending on goods tend to track one another fairly closely over time, and both (/2) tend to forecast the trend in nonfarm payrolls. What has been compellling over the past half year is the marked divergence between the two spending measures, as retail sales have declined, while real personal spending has continued to increase.

Here’s the record of both compared with jobs going back 15 years measured YoY:

On that same YoY basis now, real retail sales (blue) are down -1.6%, after a revised -2.0% in January, meaning a (noisy!) trend forecast of a YoY decline in jobs of over -0.5%, vs. the real personal spending forecast of roughly a 1% gain: