- by New Deal democrat

Last month I described the trend in consumer inflation as an ongoing “tug of war” between energy and housing. Energy (mainly gasoline) peaked in June 2022 and made its low in June 2023, while housing, which peaked in early 2023, has been gradually disinflating since.

That tug of war continued in February. Energy prices firmed, up 2.3% for the month, while shelter, which still increased 0.4% for the month, had its lowest YoY reading since June of 2022. As you may already know, both headline and core inflation rose 0.4% in February. The YoY increases were 3.2% and 3.8% respectively. The former YoY reading is in the range that it has been for the past 6 months, while the latter is also the lowest since April 2021. Here are the monthly changes in each for the past two years:

In lieu of a bunch of graphs, here is the Census Bureau’s spreadsheet. The column at the far right shows the YoY increases, where it is easy to see where the remaining problem areas are:

The only sectors still up over 4% YoY are food away from home, transport services (mainly repairs and insurance), and - still - housing. Here’s what the first two look like, plus a breakout of the motor vehicle repair and maintenance component of transport services:

Inflation in food away from home is still gradually disinflating, and is now at its lowest YoY rate of increase since June 2021. although it is still running about 1.5% above its YoY rate before the pandemic. If its present trend continues, it will be increasing at its pre-pandemic level in about 6 months.

Transportation services, however, have stopped decelerating for the last 8 months. As shown above, however, it isn’t due to repairs, which while still up 6.7% YoY, have shown sharp deceleration. Rather, it is almost all due to motor vehicle insurance (which unfortunately is not broken out separately on FRED), which was up another 0.9% in February alone, and is up a whopping 20.6 YoY!

Aside from motor vehicle insurance, as I’ve been saying for months, the only *real* remaining inflation problem boils down to shelter. To show this, below are the YoY% increases in headline inflation (which has been bouncing around between 3.1% and 3.7% for over half a year, core inflation, which has been very gradually trending downward, energy (now down -1.7% YoY, /3 for scale), and CPI ex-shelter, which is up only 1.8% YoY:

An issue has been made by a few people about whether series like the Apartment List National Rent Index, which have shown slight YoY *declines* in rents for several months, have been giving a true leading reading. While rent of primary residence has continued to increase, up 0.5% in February, the YoY comparisons continue to show deceleration, Here are the monthly% (blue, right scale) and YoY% (red, left scale) changes in the CPI for rent of primary residence:

YoY comparisons will get much more challenging beginning next month, as the final 0.7% monthly reading from last February drops out of the picture. But the last 3 months have only increased a total of 1.1%, and are the lowest 3 month average since autumn 2021. I suspect that the slowly decelerating trend will continue. If it continues over the next 6 to 9 months, YoY rent in the CPI will be about 3.4% - right in the middle of its pre-pandemic range.

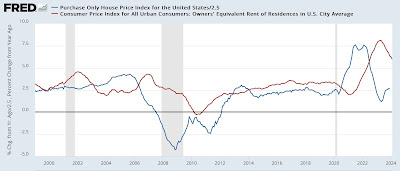

Finally, here is this month’s update of the graph comparing house prices as measured by the FHFA Index (/2.5 for scale) with CPI measure of owners equivalent rent:

Like rent of primary residence, owners equivalent rent, up 6.0% YoY, is increasing at the lowest pace since July 2022. Although house prices have resumed increasing in the past half year, the pace of those increases is in line with their pre-pandemic trend. Thus I expect the deceleration the CPI shelter index to continue, although it may do so at a slower pace.

To sum up, my conclusion this month is the same as it was last month, to wit: if there are no unpleasant surprises awaiting in the months ahead as to gas prices, we can expect headline inflation to continue to be fairly stable, and shelter to continue to show disinflation, leading to gradually lower core inflation readings as well.