- by New Deal democrat

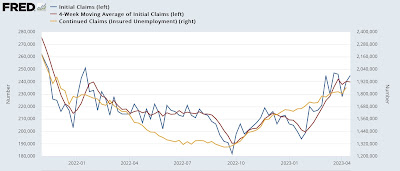

Initial claims (blue in the graph below) continued their recent track into recession caution territory this week, as they rose 5,000 to 245,000, 12.9% higher YoY and the 5th time in the last 7 weeks that claims have been 240,000 or above. The last time they were at this level was in January 2022.

The more important 4 week moving average (red) declined -250 to 239,750, 10.6% higher than 1 year ago. This is the 4th week in a row that the YoY% change has been above 10%, but it has not yet crossed the 12.5% threshold that historically has been a recession warning. On an absolute basis, except for 2 of the 4 previous weeks, the highest it had been at this level was also January 2022.

Finally, continuing claims (gold) rose 61,000 to 1,865,000, 22.1% above their level one year ago, and the highest since November 2021:

Here is the YoY% change, which is more important at the moment:

The increase in continuing claims appears especially significant. Historically, continuing claims have lagged, and have not been higher YoY by 20% or more until after a recession had already started (below graph subtracts 20% so that a YoY 20% increase shows at the zero line):

The only two exceptions prior to the pandemic were 2 weeks in November and December 1979, just before the January start of the 1980 recession, and 1 week in November 1989, 8 months before the onset of the July 1990 recession.

Parenthetically, it is important to note that the massive seasonal revisions which were announced 2 weeks ago did not significantly affect the YoY comparisons.

For forecasting purposes, this metric continues to warrant a yellow but not red flag. But if continuing claims are over 20% for even one more week, that yellow will shade closer to orange or even crimson.