(*hyperbole)

- by New Deal democrat

There’s no important new economic data until Thursday this week. Meanwhile, there was lots to digest about Friday’s blockbuster jobs report, which I have now done, so I’m going to spend a couple (maybe 3!) days diving in to the details. Today I’ll deal with how seasonality and a very tight labor market were decisively important in Friday’s report. Tomorrow (and maybe Wednesday as well, depending on the length of what I have to say) will deal with revisions to both the Establishment and Household data for 2022.

Let me start off by running the following thought by you: do you really think that bars and restaurants hired almost 100,000 more people in January, as shown in the jobs report?

Yeah, me neither. And the truth is, they didn’t! Actually, in the aggregate they let go of 183,000 employees. Here’s the seasonally adjusted (blue) vs. non-seasonally adjusted (red) numbers beginning in July 2021:

Here’s the longer term view since the start of the series in 1991:

In a normal year, in January bars and restaurants typically let go of 200,000 or more employees. Only once (in 2006) did they lay off fewer than they did last month.

The seasonal adjustment (and it’s perfectly valid, I am in no way saying it is inappropriate) translates that relative lack of layoffs in January to stellar job gains.

Similar patterns, while less drastic, appear across the jobs spectrum. Let me give one more example.

Virtually every single metric in the past several months has suggested that the manufacturing sector has entered a downturn. The ISM manufacturing new orders index is at a level that in the past has almost always indicated a recession is occurring. Manufacturing production has turned down slightly in the past several months. The average manufacturing work week has also declined sharply enough from its peak to be consistent with a recession. And in November and December, even after revisions, manufacturing added only 13,000 employees per month. So it was reasonable to expect employment in manufacturing to turn down in January. Instead, on a seasonally adjusted basis 19,000 jobs were added.

So, here are manufacturing jobs seasonally adjusted (blue) and not (red) since July 2021, showing that actually there were 91,000 layoffs, or 0.7% of the December workforce:

Here is the longer term view of the monthly % change in non-seasonally adjusted jobs in manufacturing since the modern era began in 1983, up until the pandemic, adding 0.7% so that the 2023 % would show as 0:

There were fewer layoffs this January than there were most years during that entire 35+ year period. Seasonally adjusted, that means a strong gain (again, a perfectly valid adjustment).

In fact, for private payrolls January’s monthly layoffs of 1.632% of the December workforce was the smallest in the entire 80+ year history of the data (shown as 0 in the below graph):

Government employment also jumped 74,000 in January. This was also heavily influenced by seasonal factors, but also by the return to work of 48,000 employees at the University of California who had gone on strike in November. The resulting non-seasonally adjusted decline for January of -1.5% was the least since the end of the Great Recession (note July, not January, is the month for the biggest NSA declines in government jobs):

Again, let me emphasize that there’s nothing wrong with performing this seasonal adjustment.

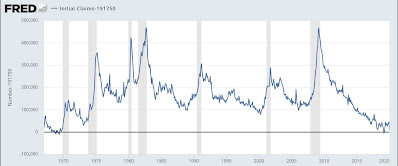

But let’s take a slight detour and look at the entire historical record for the 4 week average of initial claims up until the pandemic:

In January, an average of only 191.750 people filed for initial claims. Except for the 1960s (when the US population was only half what it is now), and March and April of 2019 and last year, this is the lowest monthly average in history. Here’s a close-up view of seasonally adjusted and non-seasonally adjusted initial claims in the last 18 months, showing that the typical early January sharp jump in claims simply did not materialize this year:

In essence, nobody* is getting laid off. There was a seasonal increase in hiring for the Holiday season, but in the aggregate businesses decided not to lay some of those people off, but keep them on the payrolls. That, plus the resolution of the California strike, is why payrolls jumped so much in January. (*hyperbole)

Which raises a question: what will happen in February? As shown on the graph below of non-seasonally adjusted employment during the last expansion, February is typically positive, leading to the peak months of March through June:

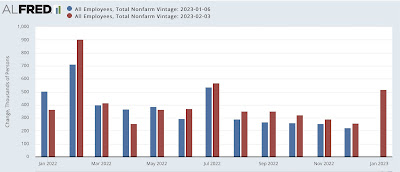

Now let’s look at the revisions for 2022 which just took place:

January 2022 was revised down from 504,000 to 364,000, while February was revised up from 704,000 to 904,000. These were the two biggest revisions of the entire year, suggesting that seasonality led those two months astray.

In conclusion, here’s what we have: in a very tight labor market, in the aggregate employers were reluctant to lay off seasonal hires in January, electing to keep them on payroll. This translated into blockbuster job gains on a seasonal basis. But we have to wait for February’s report to see whether this is a sign of renewed strength in the jobs market, or whether employers have less need to hire new workers as a result. In other words, will January’s strength continue in a month where actual hiring, not layoffs, are expected.

Addendum: It’s also been pointed out that you can’t fire in January the people you didn’t hire in October through December. In 2022, there was considerably less Holiday season hiring than in recent years, as shown in this Challenger Gray graphic from early December:

Tomorrow: the story behind the revisions