- by New Deal democrat

While we are still in our lull concerning monthly data, on Monday there was a significant update of one long leading indicator that is only reported Quarterly: the Senior Loan Officer Survey.

This survey has an excellent history of over 30 years telling us about credit conditions. Loosening of credit, and an increase in demand for credit means expansion ahead. Credit tightening and a decrease in demand for credit have only occurred shortly before, during, and shortly after recessions.

In the case of Q4 2022, the data speaks for itself.

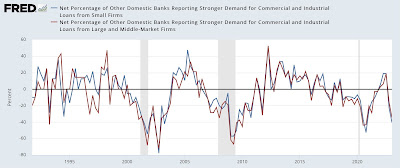

Here is demand for commercial loans by large, medium, and small sized firms:

With the exception of one quarter in 1994, a falloff in demand of this magnitude has only happened at the time of the 3 recessions since then.

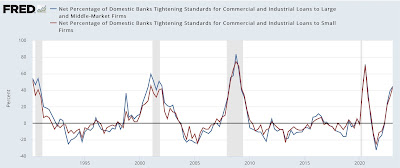

Here is the net percentage of banks tightening credit for loans to large, medium, and small sized firms. Note in this case a higher number means more tightening, so is bad:

The only time conditions have tightened this much has been in advance of or during the last 4 recessions since 1990.

Through Q4, banks were tightening credit, and firms were pulling back in asking for loans. This is recessionary, period.

Which has reminded me that I need to update my comprehensive examination of long leading indicators over at Seeking Alpha. I’ll post a link once that is done (maybe today, maybe not).