- by New Deal democrat

Even though existing home sales make up about 90% of the total market, they have much less economic impact than new home construction. They are best used to confirm trends. In January they continued to confirm that sales have continued to decline, and prices, which follow sales with a lag, have joined in.

January sales declined another -0.7% to 4.2 million annualized, a -37% YoY decline from a peak of 6.34M one year ago:

The median price of an existing home, which isn’t seasonally adjusted, also declined further to $359,000, up only 1.3% YoY from 2022’s $354,300. Since my rule of thumb for non-seasonally adjusted data is that the trend has turned when the YoY increase is less than 1/2 of its maximum increase in the past 12 months, which was the +17.1% growth of 12 months ago, needless to say this confirms that prices have turned down in a significant way:

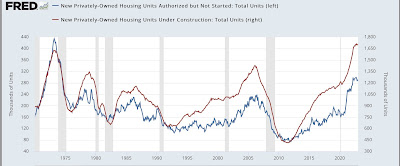

The decline in sales, as well as housing permits and starts, is certainly consistent with a recession - which has normally coincided with a decline of about 20% or more. As I’ve pointed out several times already, what is “different *so far* this time” is that this hasn’t fed through into any significant decline in the backlog of authorized housing not yet started, or housing under construction:

Until housing under construction turns down substantially, housing is not exerting any significant downward pressure on the economy.