- by New Deal democrat

Initial claims ticked up 2,000 last week to 216,000. The 4 week moving average declined 6,250 to 221,750. Continued claims, with a one week delay, declined 6,000 to 1.670 million:

To state the obvious continued good news, it remains the case that almost nobody is getting laid off.

Also continued good news is that claims, and in particular the 4 week moving average, remain lower than their level one year ago:

So long as this remains the case, we can be confident that the economy remains in expansion. I’ll hoist a yellow cautionary flag if and when claims turn higher YoY, and a recessionary red flag if they turn higher by 10% YoY.

I’ve seen some commentary that no recession can start so long as initial claims remain very low.

Historically this is not true. There has been no “magic level” of initial claims correlating with increased or decreased employment or unemployment levels. Sometimes it has taken 400,000 or more (1980, 1981), sometimes as low as 250,000 or less (1970, 1974). In 2001, it took about 370,000; in 2007, it took 340,000. The key has been a sufficient increase from the expansionary lows.

Confirmation of the above can be found indirectly via the Sahm Rule, which holds that we can be confident that a recession has started if the 3 month average of the unemployment rate has risen 0.5% from its previous 12 month lows. (Note in some cases the actual start of recessions has not required this much of an increase. Rather, the rule is one of sufficiency rather than necessity).

With that rule in mind, it has also been the case for 60 years that initial claims lead the unemployment rate. Here’s the graph that plainly shows the leading/lagging relationship from 1966 through 2019:

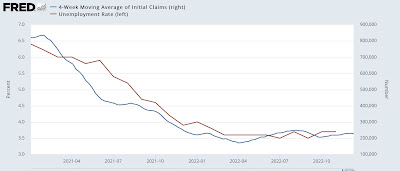

And here is the continuation of the graph for the past 2 years:

So the fact that initial claims made their low last March and remain slightly higher continues to indicate that the unemployment rate would make a subsequent low (it did, in July and September), and has also risen slightly since.

If and when the 4 week average is 10% above its previous low YoY, we can be confident that the unemployment rate will similarly follow higher (keeping in mind that a 10% increase from 3.5% unemployment is 3.85%). So initial claims will give us a good heads up as to when the Sahm rule might be triggered in the near future.