- by New Deal democrat

By now you’ve probably already read a fair amount of commentary on yesterday’s consumer inflation report for May. I’m going to cut to the chase as to my take right off the bat:

1. The primary driver of this inflationary spike is supply bottlenecks rather than increased demand.

2. The inflationary spike has wiped out any “real” wage gains during the past 10 months.

3. The inflationary spike is not a concern - yet. If this continues about 3 more months, it becomes a real concern and I would expect the Fed to act at that point.

To the graphs ...

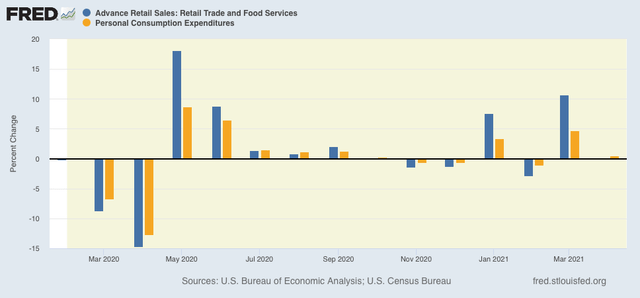

1. Here’s a look at retail sales (blue) and personal consumption expenditures (gold) since the beginning of 2020:

Just as with last year’s stimulus, the effect of this year’s stimulus has petered out after a few months. Demand has stabilized.

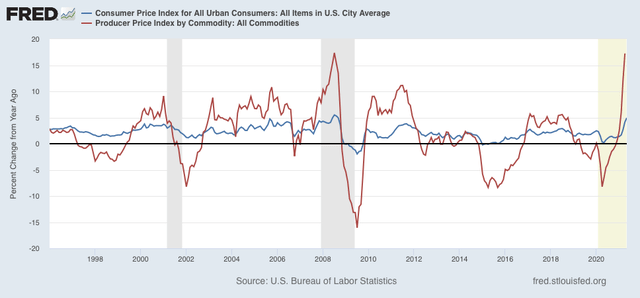

On the contrary, YoY commodity prices have spiked in a fashion last seen when gas prices hit $4.25/gallon in the early part of the Great Recession:

This *can* be a great concern, but note that there have been other spikes approaching 10% YoY in the past 25 years that did not cause recessions or even major slowdowns. Note that those spikes only lasted a few months.

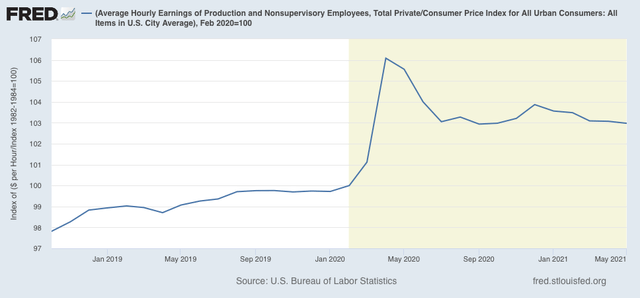

2. Here are average real hourly wages for nonsupervisory workers for the past 3 years, normed to 100 as of February 2020:

As of May, these are up 3% since just before the recession - and not at all since last July. The inflationary spike this year has actually caused them to decline slightly. This will create a problem for consumer spending (70% of the economy) if it continues too much longer.

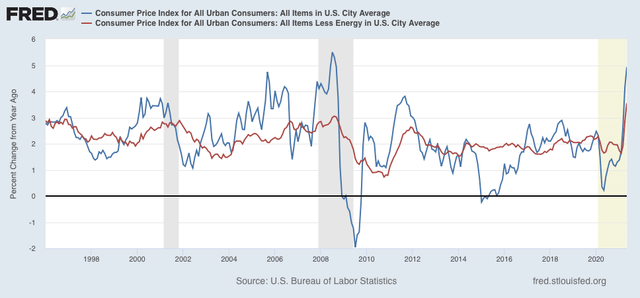

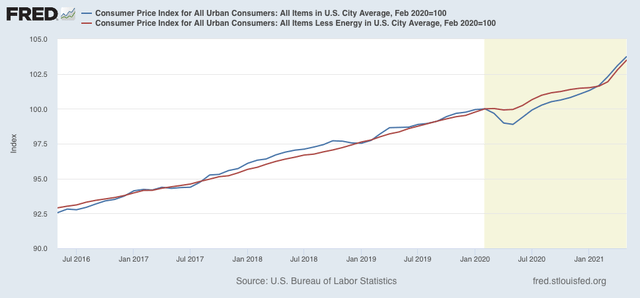

3. As I’ve said many times before, typically inflation has not been a concern over the past 25 years unless CPI excluding energy (gas) is up 3% YoY or more. As of May, we crossed that threshold:

Another way to look at this is to compare our current trajectory with that which was in place leading up to the pandemic. In the latter part of the last expansion, consumer prices were increasing at the smoothed rate of 2.65%/year. Had that trend continued after February 2020, prices would be up roughly 2.9% since then. With the inflationary spike of the past several months, they are instead up 3.8% since February 2020:

Here’s the bottom line: this is not a big deal if it only lasts another month or two. But if the trend continues longer than that, it will begin to impact consumer spending, and it will get the Fed’s attention. Unfortunately I have no special insight into supply chains; all I know is that it is important that the supply chain bottlenecks be promptly resolved.