- by New Deal democrat

New jobless claims continue to be the most important weekly economic datapoint, as increasing numbers of vaccinated people and outdoor activities have led to an abatement of the pandemic, with both new infections and deaths at their lowest point since the onset of the pandemic in March 2020.

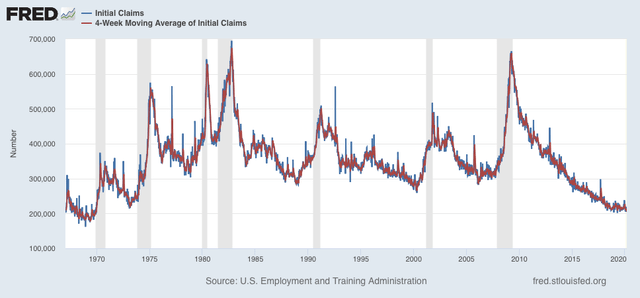

We have already hit my objectives for claims to be under 500,000 before Memorial Day, and to be below 400,000 by Labor Day. My new, final objective is for claims to average 325,000 or below, which would signify a return to normal expansion levels in the past 30 years.

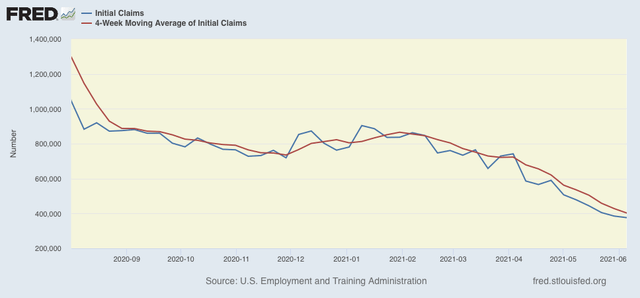

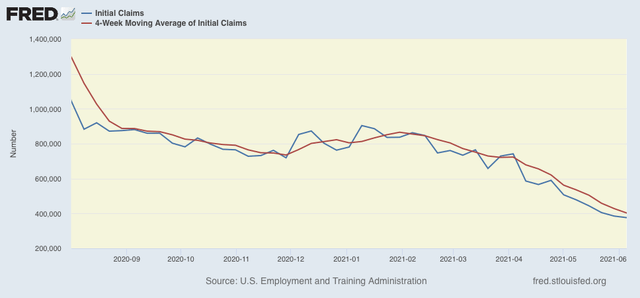

Turning to this week’s report, new jobless claims declined 9,000 to 376,000. The 4 week average of claims declined by 25,500 to 402,500. Both are new pandemic lows. (Note that I have discontinued comparisons of non-seasonally adjusted claims, as the period of lockdown distortions YoY has passed.)

At the peak of the pandemic lockdowns, new claims were running 6 million to 7 million per week. Here is the trend since the beginning of last August:

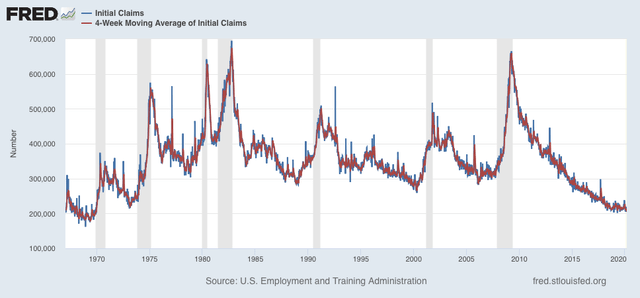

For the past 3 months, claims had trended down an average of roughly 100,000 per month. In the past several weeks, this has slowed to a rate of decline of roughly 50,000 per month, indicating that the “opening” of the economy is getting nearer to an endpoint. This also implies a slowing down of net job creation from the last 3 months’ levels. At their current level, claims are consistent with early mid-expansion levels in the past:

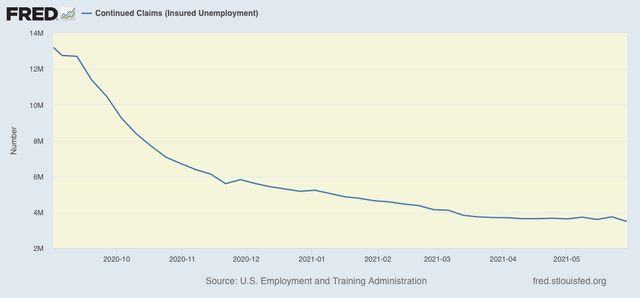

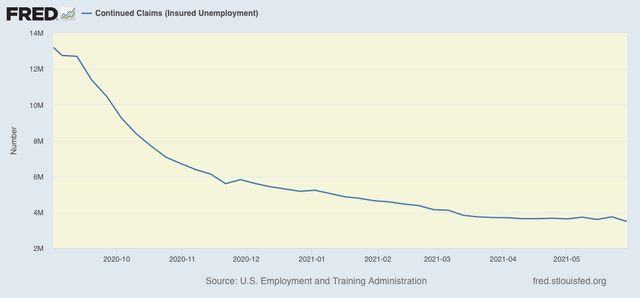

Continuing claims, which are reported with a one week lag, and lag the trend of initial claims typically by a few weeks to several months, declined 258,000 to a new pandemic low of 3,499,000. Still, over the past 2 months these have only declined about 7% from roughly 3,750,000:

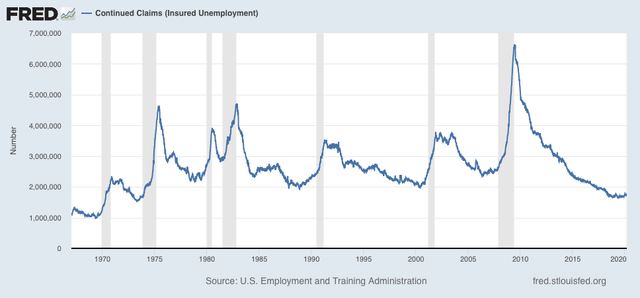

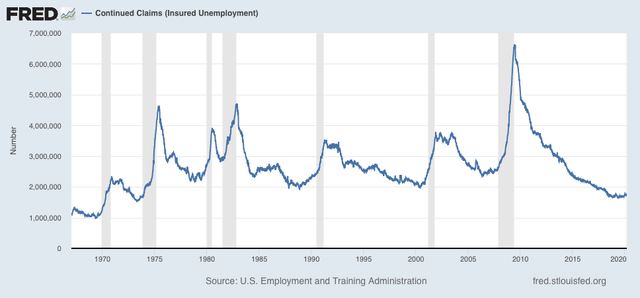

The long term perspective again shows that these are equivalent to the worst levels of most previous recessions, or early in the expansions, versus at 2,000,000 or below later in strong expansions:

I am not sure if the recent strong declines in new jobless claims will continue from here, as we approach past levels of full or nearly full employment; but the news is definitely good, as we are at least approaching more “normal” expansion levels.

The issue with continuing claims has become more complex, as this week they finally - slightly - broke out of a flat trend since the beginning of March. The picture has become much more clouded as half of the States have announced early terminations of supplemental pandemic benefits. The picture is further clouded by the sputtering rate of new vaccinations, with the Appalachian, Deep South, and Interior West sections of the country showing low vaccination rates, and an ongoing pandemic that is *not* coming to an end. I think we are going to see two tracks going forward from here, as near-normalcy does return to the more vaccinated parts of the country, while attempts to return to normalcy fail in the laggard regions.