- by New Deal democrat

Monthly data from April sets the baseline for the impact of the coronavirus on the economy. This morning we got two important benchmarks for the consumer and producer sectors.

First, real retail sales declined -15.8%, on top of a March decline of -7.9%, for a total decline since February of -22.4%:

This is the direct impact of the closure of businesses. As I said above, it sets a baseline against which May and subsequent months can be compared. I expect there to be secondary impacts spreading out from these primary closures. On the other hand, there will be some rebound - which may be only temporary, depending on what happens with new infections - from the “reopening” by many States.

It is noteworthy that the decline in sales is sharper than the decline in aggregate payrolls (red in the graph below) over the past two months:

Most likely this mainly represents a cutting back in disrectionary purchases (things like restaurants and other social activities).

The decline in sales also takes us almost all the way back to the Great Recession lows:

The April reading was only 1.7% above those lows.

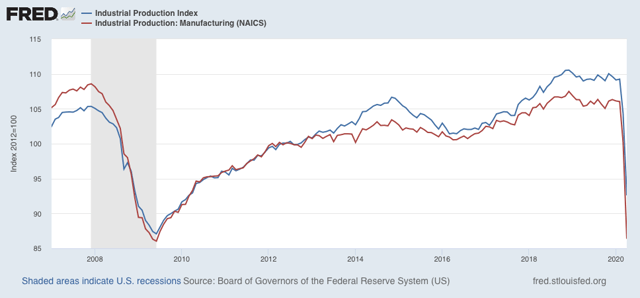

Turning to industrial production, there was a decline of -11.7%, on top of March’s decline of -4.5%. All sectors including mining and utilities suffered deep declines, but manufacturing suffered more than twice the decline in either, at -13.7%. Including March’s manufacturing decline of -5.5%, the total decline in manufacturing has been -18.5%:

This too sets the baseline for the impact of the virus. As with sales, there will be secondary cutbacks and shutdowns as the impact of the primary closures spreads out. There will likely also be some rebound where plants are reopened.

The two other important baseline numbers that will be reported for April will be housing (reported next week) and income (reported the week after that).

For now, the takeaway is that the temporary euthanizing of the economy in an attempt to contain the spread of the virus amounts to about a 20% downturn, a nearly Great Depression-like decline that will hopefully be temporary.