- by New Deal democrat

Retail sales are one of my favorite indicators, because in real terms they can tell us so much about the present, near term forecast, and longer term forecast for the economy.

This morning retail sales for November were reported up +0.2%, while October was also revised up +0.1%. Since consumer inflation increased by +0.3%, however, real retail sales were down less than -0.1%. Real retails sales remain slightly below their August peak.

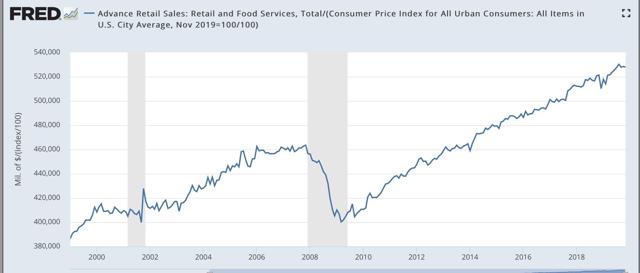

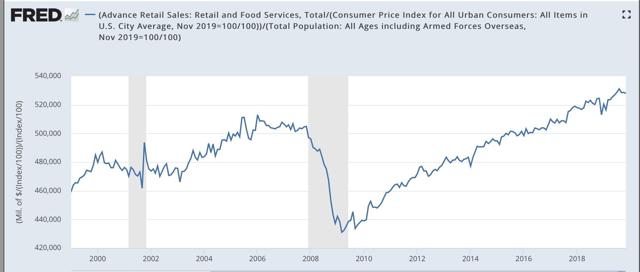

Here is what the longer term absolute trend looks like.

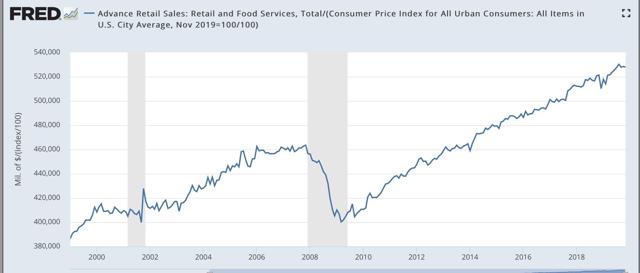

A closer view shows that the last three months’ decline remains well within the range of noise:

A closer view shows that the last three months’ decline remains well within the range of noise:

Others may use other deflators. I use overall CPI because:

1. I’ve been doing it this way for over 10 years.

2. This is the deflator used by FRED.

3. It has a 70+ year history.

4. Over that 70+ year history, it has an excellent record as a short leading indicator for employment and recessions. That’s the kind of track record I like.

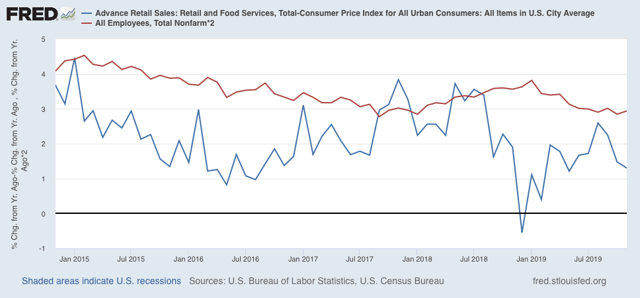

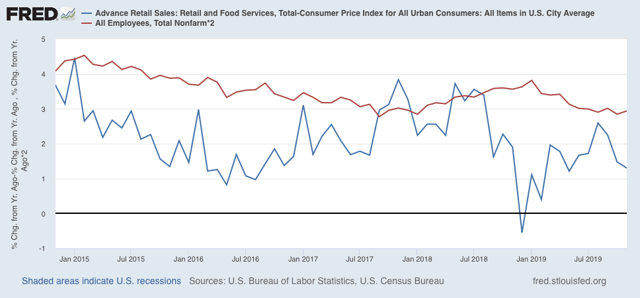

Further, although the relationship is noisy, real retail sales measured YoY tend to lead employment (red in the graphs below) by about 4 to 8 months. Here is that relationship over the past 20 years:

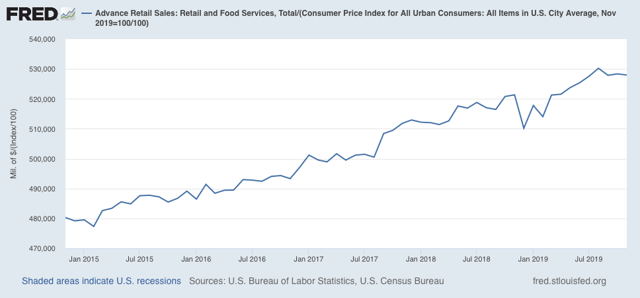

The recent peak in YoY employment gains followed the recent peak in real retail sales by roughly 6 months, and the downturn in real retail sales at the end of last year has already shown up in weakness in the employment numbers this year, as shown in this shorter term view of the past 5 years (note change of scale in payrolls better to show the changes):

Similarly even with the recent small decline at least stabilization in the employment numbers by about next spring.

Similarly even with the recent small decline at least stabilization in the employment numbers by about next spring.

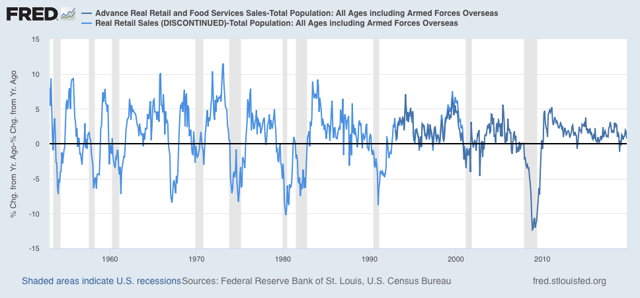

Finally, real retail sales per capita is a long leading indicator. In particular it has turned down a full year before either of the past two recessions:

In the last 70 years, with the exception of 1973 and 1981 this measure has always turned negative YoY at least shortly before a recession has begun:

Thus this is a quite reliable indicator, and with this result still being up +0.7% YoY, it is not flagging any imminent recession.

To summarize, this is a small decline from a peak three months ago. On the positive side, it is not enough for me to change this indicator to neutral, although it is enough to downgrade it to a weak positive. I will need at very least one more month without making a peak, or a more serious decline, to downgrade this indicator. On the negative side, together with yesterday’s poor weekly jobless claims number, if there is further confirmation, it *could* mark the beginning of the spread of contraction from the manufacturing sector into the consumer sector that I have been worried about.