- by New Deal democrat

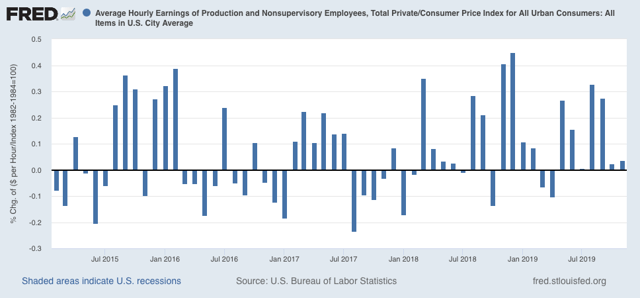

November consumer inflation came in at +0.3%. Since in last Friday’s jobs report average hourly earnings also increased +0.3%, real average hourly earnings were unchanged:

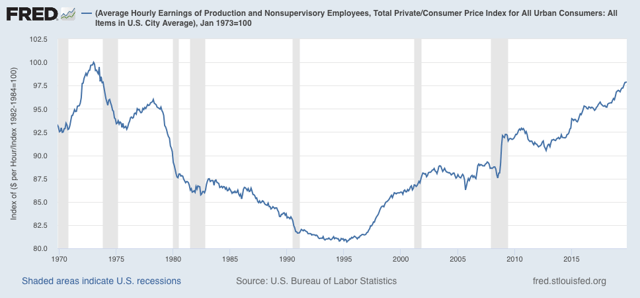

In a longer term perspective, this means that real wages remain at 97.9% of their all time high in January 1973:

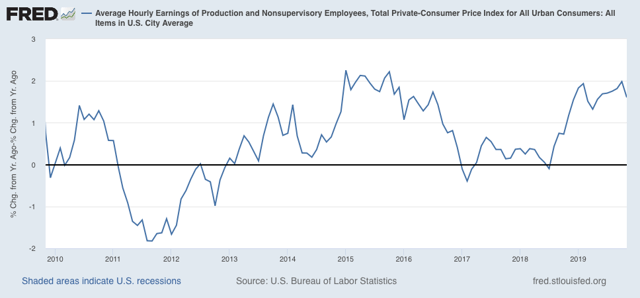

Since in November 2018 consumer inflation came in a 0%, the YoY measure of real average wages declined from +2.0% to +1.6%:

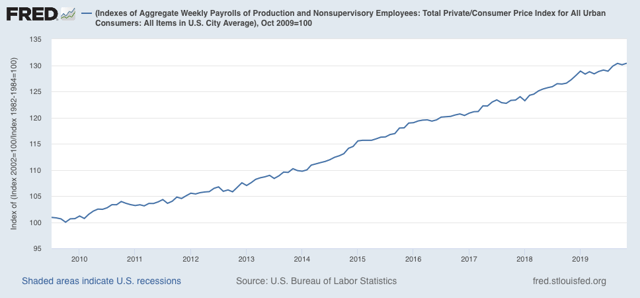

Aggregate hours and payrolls have improved significantly since July, so even though they declined -0.1% in October, real aggregate wages - the total amount of real pay taken home by the middle and working classes - are up 30.4% from their October 2009 trough at the beginning of this expansion:

As of this month, in terms of total wage growth, this expansion rises to second place, ahead of the 1960s (dated from January 1964 when record-keeping began) but still below the 1990s peak of +33.9%. Nevertheless the *pace* of wage growth has been the slowest except for the 2000s expansion.

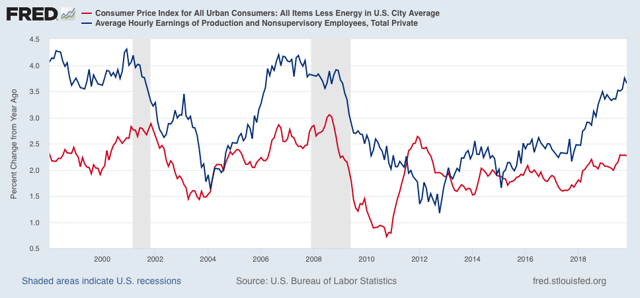

This year, 2019, has really been a boon for labor. Labor force participation has increased, undemployment and underemployment have made new lows, and somnolent gas prices combined with accelerating nominal wage growth have meant that real average and aggregate wages have risen strongly. I suspect this will mark the “sweet spot” for average middle and working class Americans from this expansion, as YoY consumer inflation ex-gas has risen back to +2.3% YoY (red in the graph below):

Should this rising inflation trend continue, along with strong nominal non-managerial wage increases (blue), the Fed is going to want to raise rates again.