- by New Deal democrat

As you know, I’ve been monitoring initial jobless claims closely for the past several months, to see if there are any signs of a slowdown turning into something worse. Simply put, if businesses aren’t laying employees off, those same people are consumers who are going to continue to spend, which is 70% of the total economy. So the lack of any such increase has been the best argument that no recession is imminent.

This morning’s report of 234,000 initial claims is enough to put us over the threshold to a “yellow flag,” but historically still has more often coincided with slowdowns rather than recessions.

To reiterate, my two thresholds for initial claims are:

1. If the four week average on claims is more than 10% above its expansion low.

2. If the YoY% change in the monthly average turns higher.

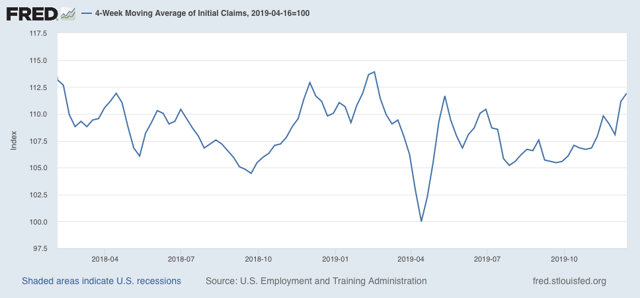

Aside from last week’s 252,000 claims, this week was the weakest but for two weeks since January of 2018. As a result, the 4 week moving average of claims has risen to 225,500, and is 11.9% above the lowest reading of this expansion, which occurred back in April:

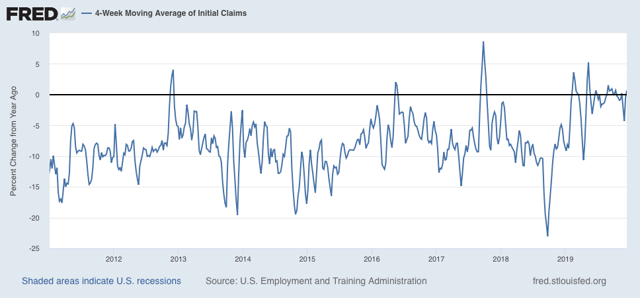

On a YoY% change basis, the 4 week average is 1,500, or 0.7%, higher:

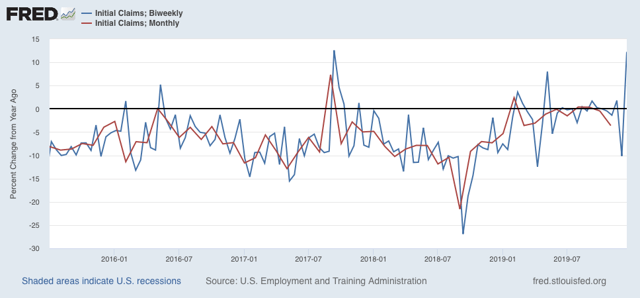

For the first two weeks of December (blue in the graph below), the average is 243,000 vs. 223,200 for the entire month of December last year (red), or higher by 9.0%, while on direct comparison with the first two weeks of last December, they are higher by 12.2%:

In short, pending the completion of December for a direct month to month comparison, both thresholds for initial claims have been met this week.

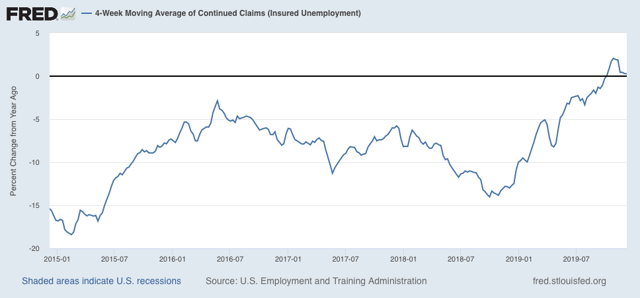

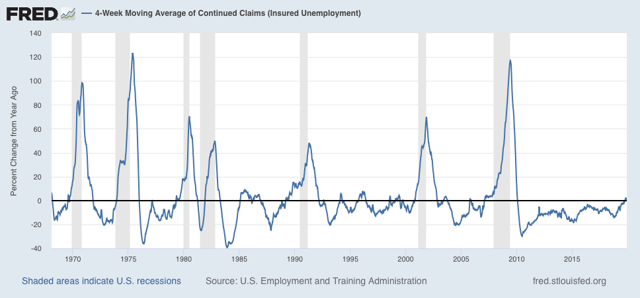

Meanwhile, the less volatile 4 week average of continuing claims is 0.3% above where it was a year ago:

Here is the longer term graph:

The four week average of continuing claims, while cautionary, is consistent with a significant slowdown. But there have been similar readings in 1967, 1985-6, 3 times in the 1990s, and briefly in 2003 and 2005, all without a recession following. So the threshold for continuing claims being a negative (vs. neutral) has not been met.

Several weeks ago I wrote that “unless initial claims start to be reported in the 230’s, and continuing claims continue to trend higher, into the 1.770 million range (by mid-December, after which the YoY comparisons for continuing claims get much easier), no interim recession will be signaled.”

For the last two weeks, both numbers have been in the 230’s or higher, and 4 of the last 6 weeks have been above 225,000. Because continuing claims have not climbed meaningfully higher, and because we still have two weeks left in December, there is no red flag.

For the record, if the four week average of claims is more than 12.5% higher than their low, that will be a red flag. If they move more than 15% higher, and the YoY changes are higher for two months in a row, that would mean a near-term recession were almost certain.

For the last two weeks, both numbers have been in the 230’s or higher, and 4 of the last 6 weeks have been above 225,000. Because continuing claims have not climbed meaningfully higher, and because we still have two weeks left in December, there is no red flag.

For the record, if the four week average of claims is more than 12.5% higher than their low, that will be a red flag. If they move more than 15% higher, and the YoY changes are higher for two months in a row, that would mean a near-term recession were almost certain.

But we have just enough as of this week to move this short leading indicator to a yellow flag, I.e., from neutral to weakly negative.