- by New Deal democrat

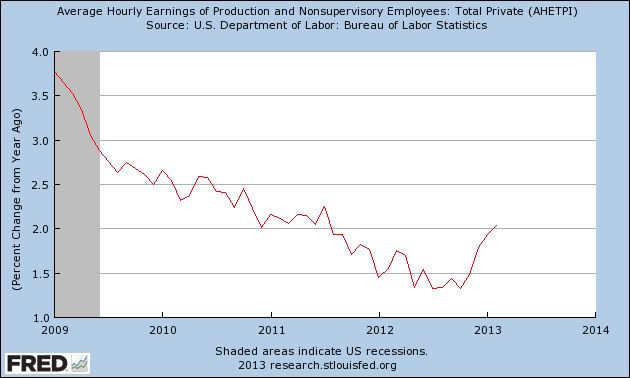

One of the important issues I've written about a number of times in the last few years is the battle of consumer debt deleveraging vs. wage stagnation. Even at the beginning of the 2008-09 recession, wages were still growing at about 3% a year. Yet in late 2012, despite the economy being in recovery for over 3 years, wages hadn't kept pace in real terms, with nominal wage growth declining to about 1.5% a year.

Thus, even a very mild consumer price inflation of 2% left workers behind. My fear has been that we would have almost complete wage stagnation at the start of the next recession, whenever that would be. We barely escaped wage deflation in 2009; it would be extremely difficult to escape it in the next downturn.

In the last few months, that has changed. The change in YoY wages has increased to over 2% a year, while inflation has decreased to 1.6% YoY, giving workers their first significant improvement in over five years:

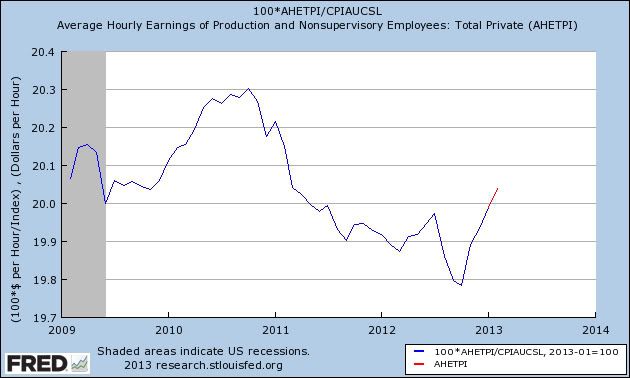

Not only that, but as you can see from the next graph, real hourly wages (average hourly wages divided by the CPI) are now as high as they were two years ago as well.

Needless to say, this is welcome news.

And while you can count me as very surprised that it happened in the presence of a 7.7% unemployment rate, there's a reasonable chance it's not fluke, it's for real.

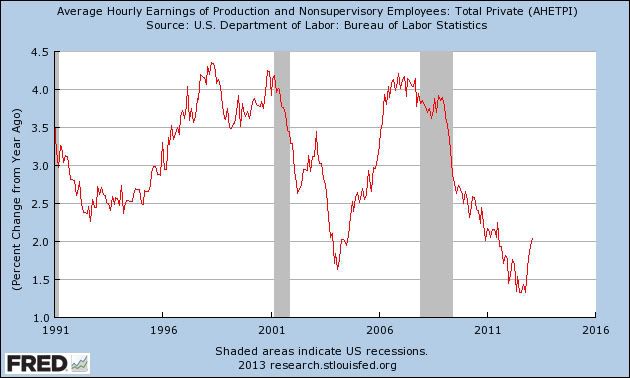

Here's the same graph of average hourly wages for the last 20 years:

As you can see, similar sharp reversals happened in both the mid 1990's and mid 2000's - although with one false positive in 2002.

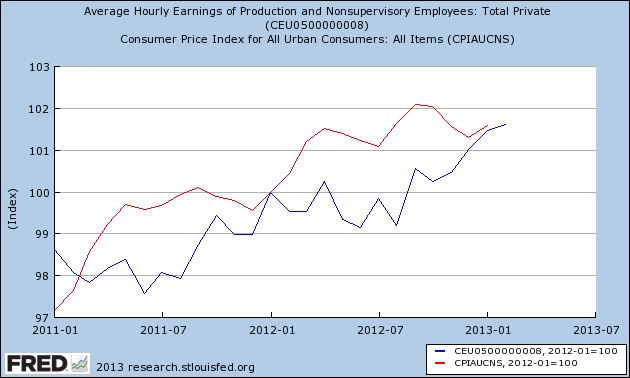

The pattern also shows up when we back out and examine real hourly wages over the last 20 years:

Note that over this time span, real hourly wages have typically risen either during recessions or at about mid-cycle. During recessions they rise because, while growth in average wages are decelerating, inflation is decelerating even more (or even turning into deflation) due to the economic weakness, i.e., producers aren't able to pass on price increases, and may have to cut prices. In mid-cycle they tend to happen as employers raise wages to attract more talent.

A final graph, setting both seasonally unadjusted average hourly earnings (blue) and seasonally unadjusted consumer inflation (red) to 100 as of January 2012, shows that this is primarily about the Oil choke collar loosening slightly:

Notice that inflation has spiked vs wages each spring as the price of gas goes up, and notice the extra spike coinciding with the price of gas going up to $4 a gallon last Labor Day. Consumer prices in February are expected to rise sharply with the price of gas last month, but right now gas prices are actually negative YoY.

As I said above, this could be a fake-out, especially with unemployment still at 7.7%. But I don't argue with the data, and certainly not when it's a positive surprise!