. - by New Deal democrat

Yesterday the econoblogosphere was all atwitter about a MasterCard report that consumers had only spent 0.7% more this holiday season vs. last year. This is said to be the weakest showing since the recession collapse of 2008,

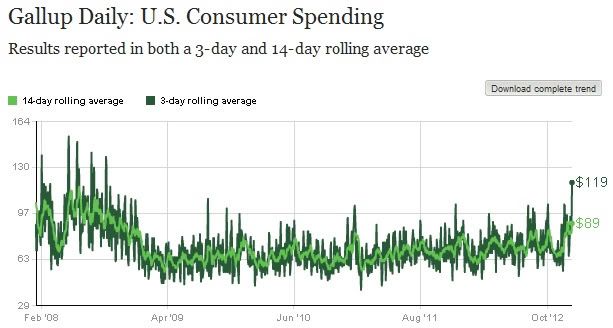

But before you accept that a the final word on the subject of consumer sales at year end 2012, take a look at this screenshot of Gallup's daily consumer spending report published yesterday, covering data fron February 2008 through December 23:

The last two weeks have seen the highest amount of consumer spending since 4 years ago, and the spike last week is by far the highest since 4 years ago as well.

So, how does this square with the MasterCard result? Two reasons are likely. First of all, the MasterCard result includes all shopping since October 28, i.e., just before Sandy. Spending was depressed from then until mid-November. Second, MasterCard is reporting credit card purchases only. Gallup, by contrast, is a relatively small sample - and so more volatile - and further is a self-report of all consumer spending. So while credit card transactions may only have increased slightly, cash buying by more frugal or budget-conscious consumers may have increased more substantially.

So I'm certainly not saying that the MasterCard data is wrong. But the Gallup consumer data earned its bones during the debt ceiling debacle last year, when it accurately and in real time showed that consumers were not slowing their spending.

Bottom line: the consumer may not have been as Scrooge-ish as reported yesterday.