- by New Deal democrat

The global economic weakness that has intensified as this year has progressed has greatly tamped down inflation. If wages were growing at a reasonable rate, this would help jump-start demand.

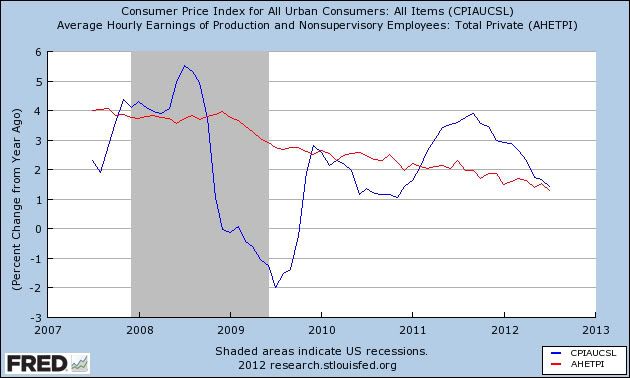

But wage growth has been declining for years, and is considerably worse than even during the Great Recession. As a result, even though inflation Is now only running at 1.4%, wage growth at only 1.3% is still not quite keeping up, as shown in the graph below:

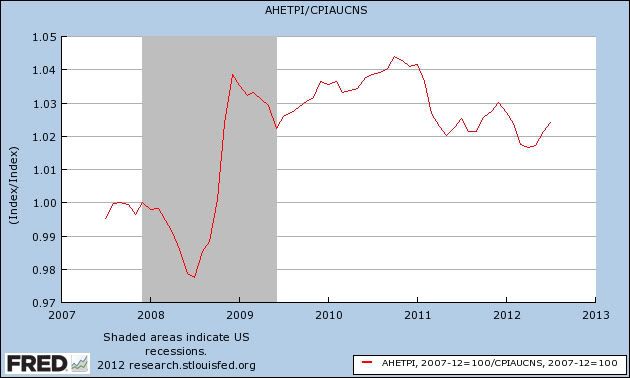

Thus, while real wages have improved slightly in the last few months, they still are below the average levels of the last four years:

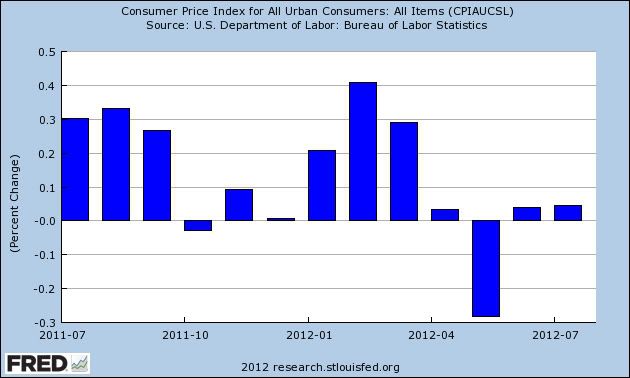

If we can avoid another inflationary spike in the next few months due to gas prices - by no means a sure thing - inflation should be less than 1%YoY in a couple of months:

Per my past postings, if inflation bottoms out at that point, that should mark the low point of the recent weakness. But we are getting ever closer to the point where wage stagnation rolls over into actual wage deflation.