Both academic economists like Prof. Brad DeLong, and lay observers have voiced skepticism, even "alarm," that economic indicators developed from post-WW2 inflationary recessions, usually brought about by Fed tightening, are applicable to deflationary scenarios brought about by asset and credit contraction like the present. In response to that, for over a month I have been testing publicly available economic data series that go back to the 1920s at least.

But did the founder of ECRI, and the father of modern business cycle research, Prof. Geoffrey Moore, leave behind no public record, in particular a record discussing Leading Indicators for pre-WW2 recessions? It turns out he did, in the form of a very thorough 1961 manuscript, available from the NBER via the St. Louis Fed, in which he identified and discussed Leading Indicators from the pre-WW2 period (as to some of which data went all the way back to 1854) and tested them to see if they applied to the post war recessions of the late 1940s and 1950s. They did.

The meat of his discussion is found in Chapter 3 of the manuscript, from which the following quotes are taken.

Prof. Moore summarized the study and its results as follows:

Before the war, in 1937, Wesley Mitchell and Arthur Burns picked a set of twenty-one indicators from among the several hundred time series that the National Bureau had analyzed in its study of business cycles. [NDD note: Mitchell and Burns' 1937 manuscript is here] After the war I undertook to redo the job and in 1950 published a new list of twenty-one indicators. They are classified in three groups— leading, roughly coincident, and lagging—according to their tendencyto reach cyclical turns ahead of, at about the same time as, or later than business cycle peaks and troughs. Many of the series in my list were either identical with or closely related to those in Mitchell's and Burns' list, but I omitted some that seemed redundant or of dubious value, and added some on the basis of new information. But both their study and mine were based on prewar information about the cyclical behavior of the data. The experimental part of the project consists in seeing whether this prewar information provided a useful guide to the postwar behavior of these data in relation to business cycles.(emphasis supplied)

....

Most of the prewar relationships exhibited by the twenty-one indicators have survived a great many years and a wide variety of so-called "structural" changes in the economy. .... [T]he only series that should be shifted would be personal income, retail sales, and corporate profits. The first two now appear to be better classified in the roughly coincident group, and the third in the leading group. .... The other series have all behaved in a manner consistent, or at least not inconsistent, with their prewar record

Comparing his list with the 1937 list, Prof. Moore noted that:

[O[f the twenty-one indicators selected by Mitchell and Burns in 1937, only [two are] on our new list [of leading indicators]: business failure liabilities ... and average workweek in manufacturing

Prof. Moore categorizes the themes of the data series that proved useful as Leading Indicators as follows: (1) sensitive employment and unemployment indicators - in particular, hiring and firing in manufacturing, (2) commitments to new investment, (3) business profits and failures, and (4) inventory investment and industrial commodity prices.

He found that, as to the comparison of the postwar [WW2] with the indicators selected on the basis of prewar records did show that "What is significant, and encouraging, is the fact that the postwar record is substantially the same as the prewar record."

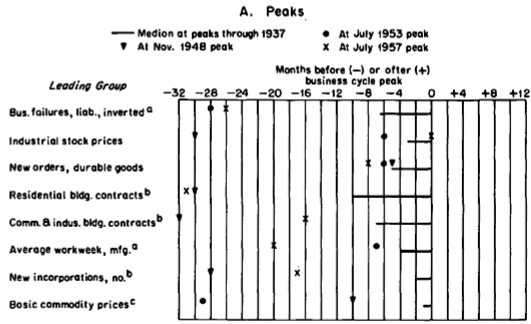

Here is Moore's list of Leading Indicators from the era before WW2, showing their typical leads in pre-WW2 recessions, and showing their continued viability thereafter, first as to economic peaks:

And here it is as to troughs:

Note that 4 of the leading indicators from the pre-WW2 era -- housing starts, stock prices, new orders for durable goods, and the manufacturing workweek -- are still on the list of 10 LEI's today. This should give us a great deal of confidence that what they show now is as valid as what they showed in the last 100 years and beyond.