Recently I've begun measuring the impact of energy costs not just by the price of West Texas Intermediate Crude (WTIC) which closed last week just under $80 a barrel, but also by the price of gasoline at the pump. That's because there has been a unique but marked divergence between WTIC and Brent crude in the last 12 months.

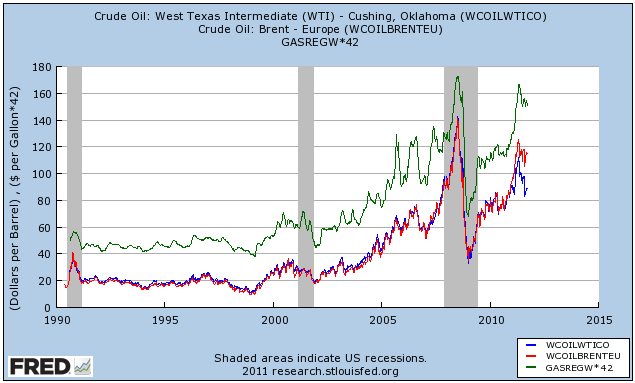

Here's a graph showing WTIC (blue) and Brent (red) oil prices in barrels, compared with the price of gasoline at the pump (green, converting gallons into barrels for consistency):

Note the unusual divergence between the blue and red lines in the last year.

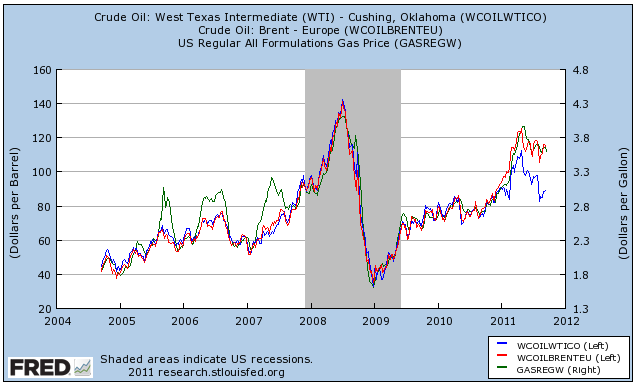

Now here is the same data, focusing on the last 7 years, and pricing gasoline in $ per gallon (right scale):

Now here are the peak prices this year and recent prices for Brent, WTIC, and

gas at the pump:

Brent: high $125.36 on 4/29, up 46% YoY

$114.98 on 9/16, off 9% from peak

WTIC: $112.30 4/29, up 33% YoY

$89.22 9/16, off 19% from peak

Gasoline: $3.96 on 5/9, up 34% YoY

$3.60 on 9/19, off 9% from peak

Gas at the pump has clearly been following Brent, not WTIC. Professor James Hamilton previously indicated a 50% YoY increase with the necessity of about $130 Oil to meet his criteria for an Oil shock recession. If we measure in Brent, as opposed to WTIC, we just barely missed those recession criteria.

It is important to note, however, that Professor Hamilton has advised that in his research, he has used the producer price index for crude petroleum, which averages the crudes by their importance to refiners. Further, he notes, if we go by this measure, we were still 7% off the 3-year peak at the end of 2011:Q1.

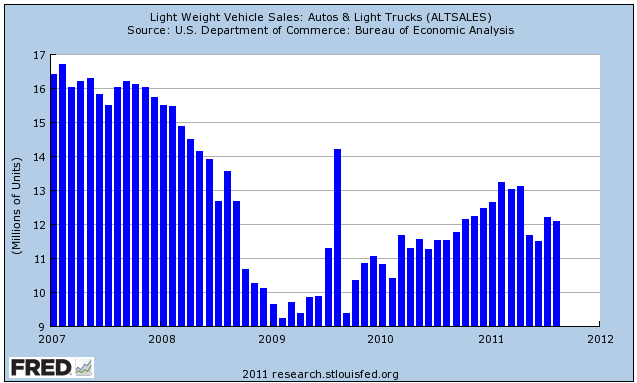

One of the first places we would expect an Oil shock to turn up is in sales of automobiles. In that regard, here are auto sales for the last 5 years:

Auto sales have indeed behaved as if there was an Oil shock induced reduction of demand beginning in May of this year. Because of the supply chain effects of the tsunami in Japan, we cannot know how much of the fall-off in demand was due to that vs. a reflection of high gasoline prices.

The decline in consumer purchases of durable goods in the last few months has been an important part of the weakening economy. With the effects of the tsunami wearing off, September auto sales reported next week will assume an added importance. Via Calculated Risk and the LA Times, for the first half of the month, sales were encouraging.