To hear much of the breathless commentary yesterday, the world is on the verge of another 2008-style financial seizure, where nobody is willing to loan anybody else any money for fear that their counterparty (typically, a European bank) could suddenly be found insolvent.

Indeed, if one looks at the six month trend in several measures of banking risk often cited in 2008 - the TED spread and the LIBOR rate - there certainly has been a spike.

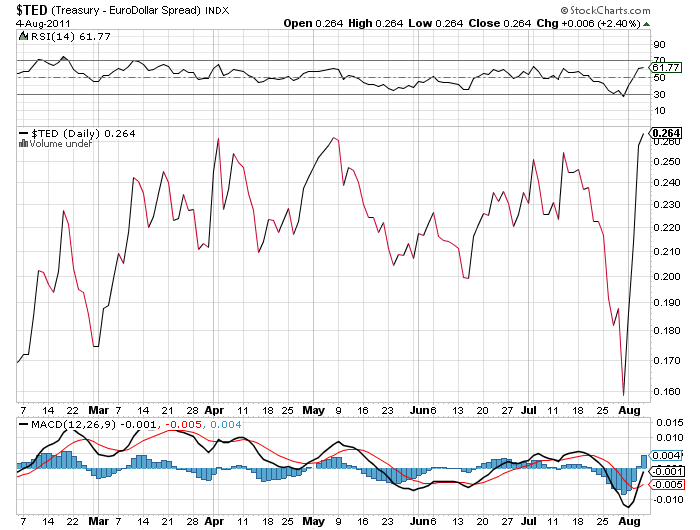

Here is the recent TED spread:

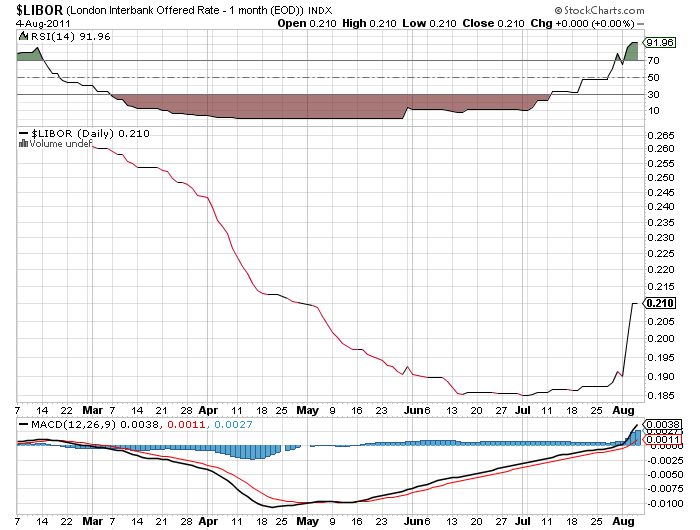

and here is the recent LIBOR rate:

ZOMG, the banking system is seizing up!!!

Right?

Well, if you take a longer term look, not so much ....

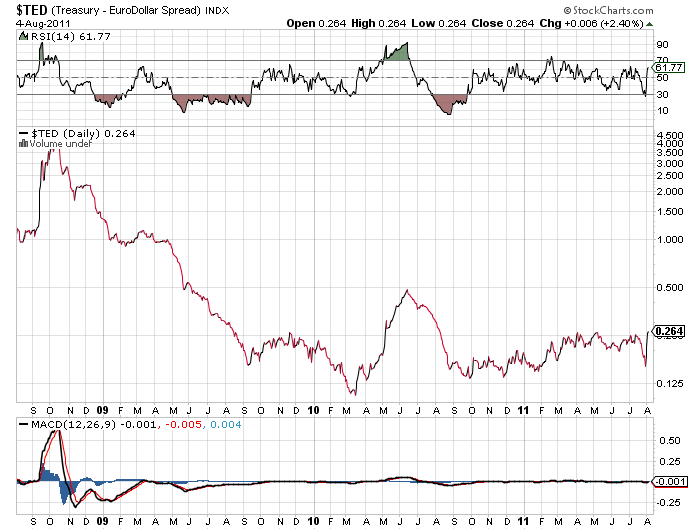

Here is the three year history of the TED spread:

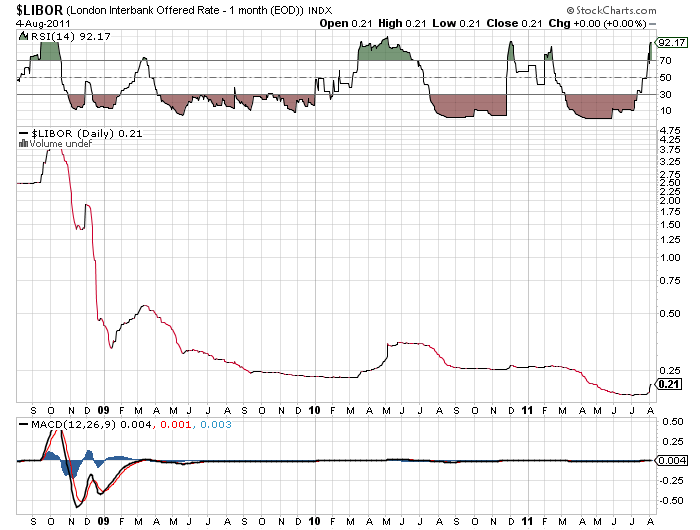

and here is the three year graph of LIBOR:

Neither of these measures of banking risk have even approached their summer 2010 highs, and aren't even in the same league as their 2008 readings. Simply put, whatever happened yesterday had nothing to do with fear of banks suddenly becoming insolvent a la the crisis of 2008. To repeat, these readings show no meaningful increase in fear of a financial system meltdown.

Instead of putting their money under mattresses, the clear winner this past week has been bonds. Ironically, for all of the idiocy surrounding the US debt limit, US treasury bond prices have been skyrocketing (and yields falling to near their 2008 lows).

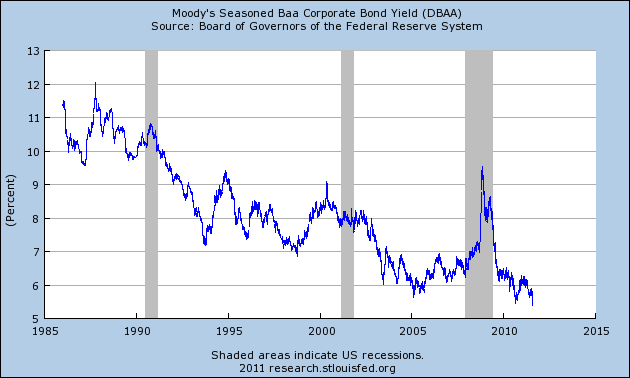

But it isn't just government bonds. Here is a graph of BAA corporate bonds going back 25 years:

Indeed, BAA corporate bonds are now yielding their lowest rate since 1966 - 45 years ago!

Recently I've also highlighted the Dow Jones Bond Average as a good leading indicator in deflationary eras such as the 1920s and 1930s, and pointed out that it both peaked and troughed in advance of stocks in the 2008-09 recession. Here is a graph of the DJ Corporate Bond Index for the last five years through Wednesday:

This series made a 5 year high on Wednesday. It surged another .72 yesterday to 115.92 - close to its all time high.

If we are on the verge of another destructive recession, some B grade corporations will default on their bonds. And yet the markets show no such fear.