Following up on my last post, I wondered whether the secular shift to hours worked vs. jobs added in recoveries also fit better with the metric of real retail sales.

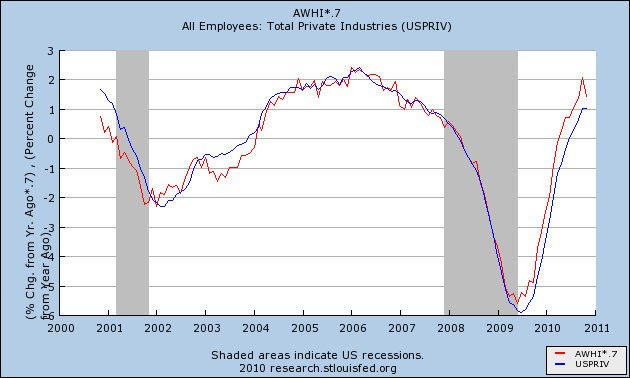

To start with, here is the last ten years of hours worked in private industry vs. private payrolls, measured YoY:

The two series fit like tightly, showing ever so slightly over 10 years the secular shift.

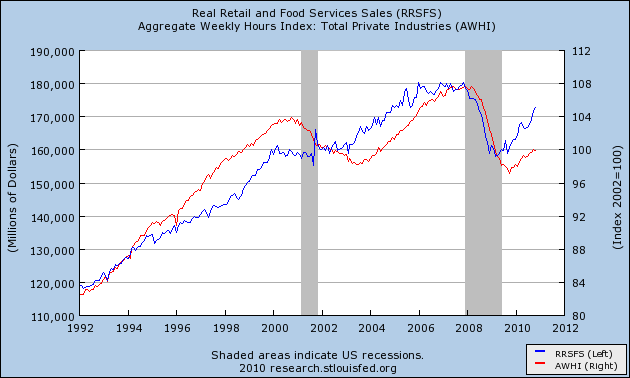

Now here are real retail sales vs. hours worked in absolute terms:

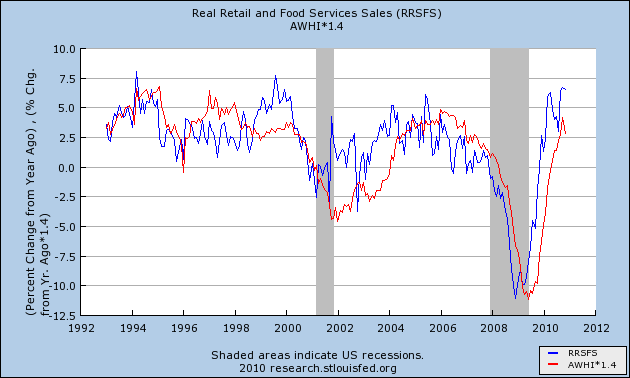

and here they are measured YoY:

:Real retail sales maintains its status as a leading indicator, in this case for hours worked, and if anything the series fits more tightly than real retail sales vs. payrolls, with the exception of the dot-com boom and bust.

----

P.S. I'm probably preaching to the choir here, but I hope posts like I've put up in the last week dispel any claim that I am an economic "cheerleader" or "Pollyanna." I started out with intellectual curiosity about the historical durations of 400,000+ jobless claims, was completely surprised by what happened when I normed those for population, and raw intellectual curiosity took over again from there. I go where the data leads me, it's that simple.