So the Recovery remains "jobless" for at least one more month.

[Note: the graphs below do not include this morning's data, but are current through last month. I will substitute the December graphs as soon as they become available]

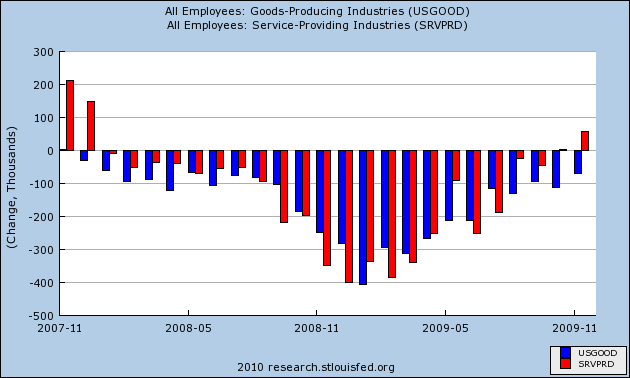

I. After gaining jobs for two months, services (where 85% of Americans work) were reported to have lost (- 4,000). Job gains were reported in professional positions +50,000, including both health and education. Retail showed a gain of +4,000. Temporary jobs - typically added while employers wait to see if the economic improvement is more sustainable - went up for the 5th month in a row, by +47,000.

The BLS report continues to track reasonably close to the private ADP survey, and out of line with the private ISM manufacturing and non-manufactuing surveys.

Manufacturing lost (-27,000) jobs. Construction, in the epicenter of the economic downturn, continued to shed jobs at (- 53,000), mirroring the lackluster performance of home sales and the continuing plunge in nonresidential construction.

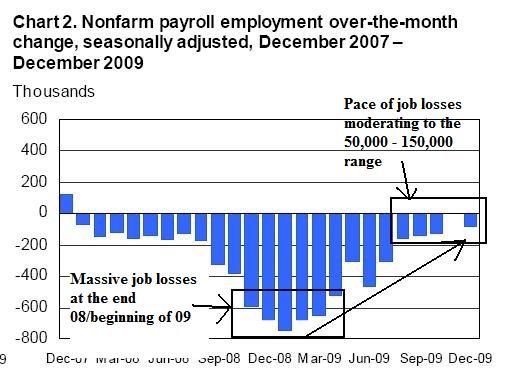

This is generally a continuation of the trend that began two months ago, when services jobs (red in the graph below) first showed growth in the payrolls report, but goods producing jobs (manufacturing + construction) (blue in the graph below)were still negative (a pattern seen at the end of past recessions).

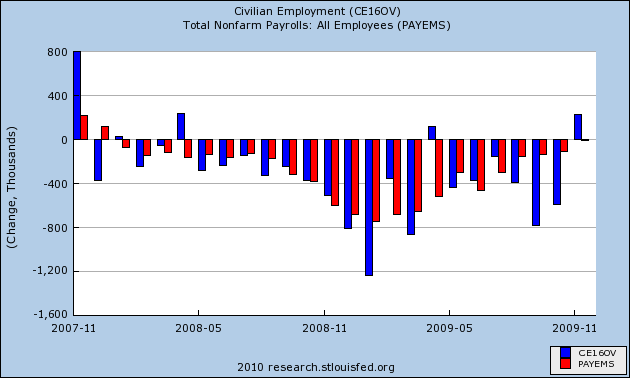

As many of you already know, in fact there are two surveys -- the "establishment" survey which polls businesses, and has received much criticism for its "birth/death" adjustment; and the "household" survey, conducted by the Census Bureau, which polls households, and does not have any such adjustment. The two do not measure the exact same thing (e.g., self-employment is not counted by the BLS), but track each other closely over time. Typically the household survey turns simultaneously with or one or two months ahead of the establishment survey.

The household survey (blue in the graph below vs. red for the establishment survey) turned positive last month, but this month returned to (-589,000).

This means the household survey has not yet turned.

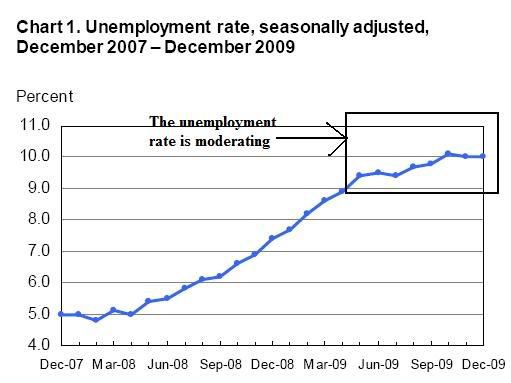

II. The other big number reported this morning is the unemployment rate, which remained at 10.0%.

The alternative U6 number rose slightly from 17.2% to 17.3%This is in large part a reflection of the fact that discouraged workers continue to leave the economy. The labor participation rate (how many people participate in the jobs economy) fell to 64.6%. Keep in mind that the unemployment rate is the last thing to turn positive in an economic recovery.

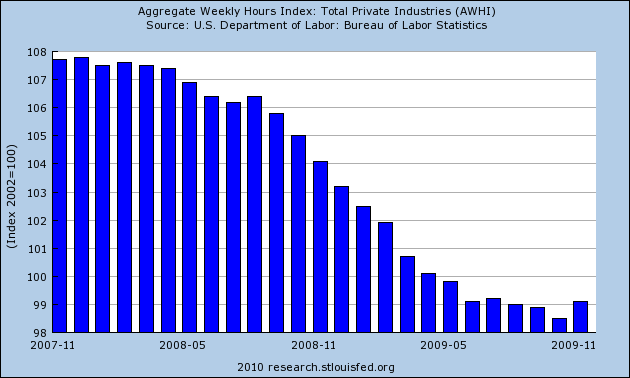

III. While the above are the headline numbers, there are other aspects of the report that are also very noteworthy. The aggregate number of hours worked in the economy bottomed in Ocotber, improved in November, and remained the same in December.

This means that in addition to hiring, hours of work are also increasing. It is also a measure relied on in part by the NBER to date the end of Recessions.

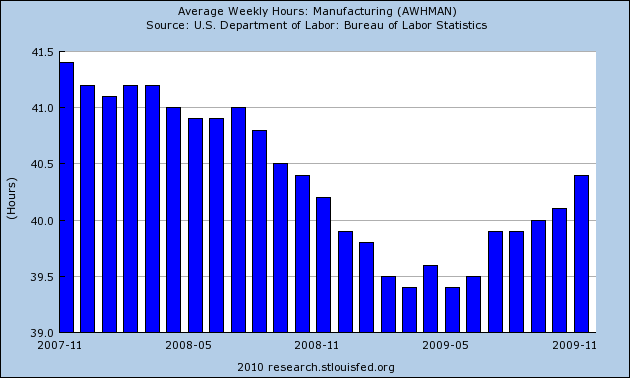

Another noteworthy item is the average number of hours worked in manufacturing. This is one of the 10 Leading Economic Indicators I refer to. It turned up back in the summer, and is an item I said to watch in terms of the possibility of a V-shaped recovery. It has risen substantially since then, but remained even at 40.4 hours from November to December:

One more statistic thought to lead employment is hours worked in overtime, as typically employers will add to overtime in their workers before they hire new ones. This also reamined the same at 3.4 hours:

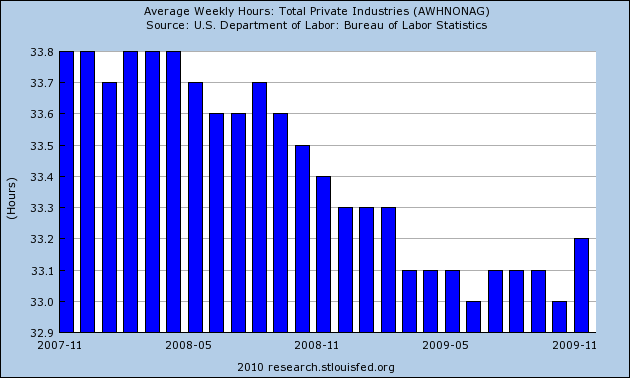

The overall average workweek, which includes services and other jobs as well, remained constant at 33.2 hours:

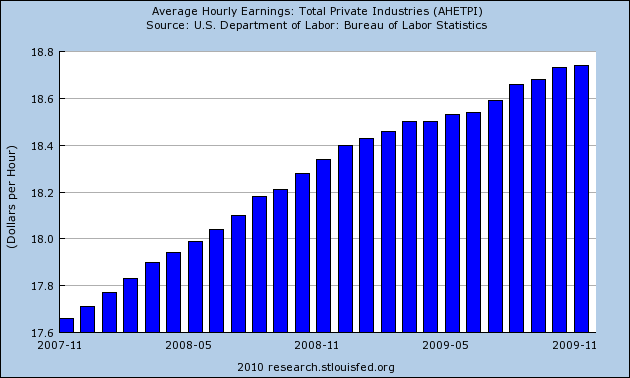

Hourly earnings also increased 0.2%, in line with expectations.

At least on a temporary basis, this is a discouraging report. Expectations were for essentially a 0 number this month. Remember I mentioned at the beginning the upward revision into positive territory of November? That was the 8th time in 9 months that the initial report had been revised higher. I recall the Septemeber report which was initially seen as a very discouraging (-269,000) jobs lost, but two months later was revised to (-175,000). The forward looking parts of this report continue to show improvement (more temporary hiring) or remained intact (overtime, manufacturing hours). The payroll series is notoriously noisy, and the trend -- which is obviously even if we just average over 2 months -- remains that jobs will be added shortly.

Back in September, I said that it was likely that jobs would bottom in November or December, +/- 1 month. While it may be proven false in a month or two, I believe that it remains a reasonable forecast.