- by New Deal democrat

You're going to be hearing a lot in the next 3 months about inflation. While at the moment we are still about 1% into deflation, year over year, that is going to end in the next week or two when the October CPI comes out. By the time the December CPI is reported in January, we'll be at about +3% YoY. You are going to be told that Inflation has made a Big Comeback, and that various Highly Respected Analyists think that it might get Out of Control.

No doubt Larry Kudlow and his ilk will suddenly rediscover fiscal rectitude, and the econoblogosphere's Doom and Gloom contingent will be positively quivering in moist anticipation of the Final Vindication of their -flationary (hyperin, or de, they're not sure) prophecies, because government stimulus and deficits have finally crowded out private borrowing and interest rates are sure to hit 10% shortly.

Ignore them. They're wrong. What you will in fact be seeing is simply and completely All about Oil.

You may recall that near July 4 of last year, Oil was priced at $147 a barrel, and the average price for a gallon of gasoline was over $4. Then it crashed. Briefly at year's end, Oil was down to $35 a barrel, and you could get a gallon of gasoline for about $1.40. Now Oil is back to $80, and a gallon of gas costs over $2.50.

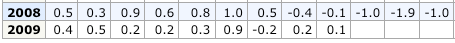

All of that was reflected perfectly in the monthly inflation statistics. Here is a screenshot of the BLS monthly readings, non-seasonally adjusted, of consumer prices for 2008 and 2009:

The roller coaster ride of the price of Oil is reflected in the surging inflation figures of early 2008, the crash in inflation in later 2008, and the renewed inflation of earlier this year. What has yet to be wiped out in the YoY statistics are the very large drops of October-December 2008. If consumer prices simply remain stable (NSA), then we will hit 0% or so this month, 2% in November, and 3% in December. All because some very large deflationary readings from a year ago will have disappeared from the calculations.

Unless the economy is surging next spring, and speculators are seriously stupid about bidding up the price of Oil, we are simply not going to see a repeat of the big positive numbers from the first half of either 2008 or 2009. More likely, inflation will settle in to something like the 2% to 2.5% range in the first half of next year, as smaller seasonal positive readings enter the annual calculations.

By next June the fiscal rectalists and hyperventilating Doomers will have moved on to their next wrong predictions. In the meantime, I've saved you a lot of trouble.