Apparently, the curse of my blogging life is the sisyphian task of debunking the use of lagging indicators to forecast the future.

One of the gloomy meme's du jour for the last few days has been how the record year-over-year post-WW2 drop in consumer credit presages worse times ahead. Just for example, here's Mike Shedlock:

Today, consumer credit contracted at a pace that is shockingly twice as bad as March, even though the March contraction was the biggest drop since 1990....

Looking ahead, Christmas season is likely to be miserable with poor sales, poor margins, more store closings, and more bankruptcies. Consumers are increasingly going to be asking "Do I really need this" as well as "Can I really afford this?" Increasingly, the answer is going to be no.

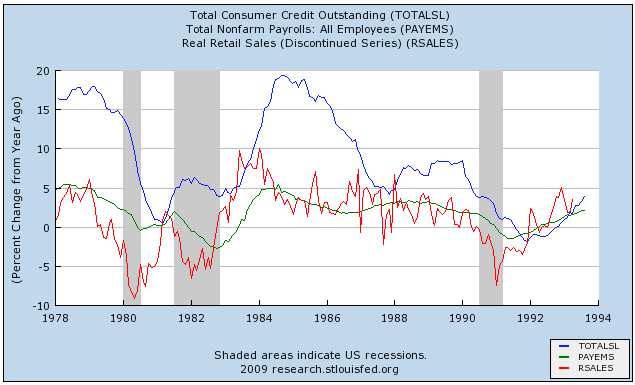

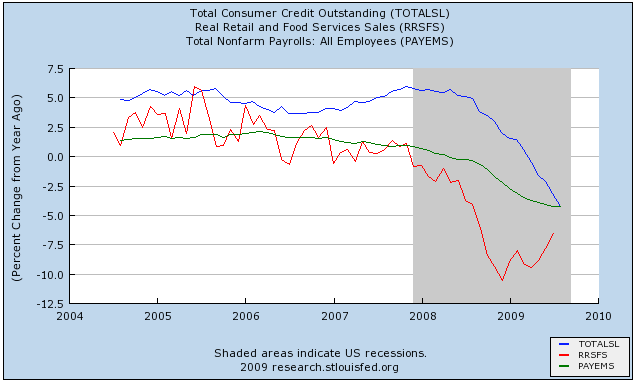

There's just one small problem with that analysis. Consumer credit is a totally reliable lagging indicator. Here's a couple of graphs showing the relationship among 3 data series: real retail sales (red), jobs (green), and consumer credit (blue). I have graphed in year-over-year terms to better show the trend, so this is the "first derivative" of the "real" numbers -- but the general relationship holds for the "actual" numbers as well. Notice the order in which each series turns.

Here's the 1980s and 1991 recessions:

and here is the current "Great Recession":

The order is unmistakably clear (and it goes back as far as the data has been kept);

1. First, real retail sales turn (red).

2. Then, jobs turn (green).

3. Finally, about a year after real retail sales turn, consumer credit turns (blue).

Real retail sales turned in December 2008.

Jobs are turning now.

Consumer credit will probably turn in about December.

So, Mish is projecting a lagging indicator to predict what a leading indicator will show in four months. To the contrary -- granted this is a really low-expectations comparison -- it appears far more likely than not that this year's holiday sales will be better than last year's.