From the NY Times:

Every major credit card issuer has been approving fewer new applicants, reining in credit lines and canceling unused accounts. And Meredith A. Whitney, a prominent banking analyst, expects credit card lenders to cut the lines of credit they extend to borrowers by a total of $2.7 trillion through 2010. That is equivalent to a 57 percent reduction in the credit they made available two years ago at the height of the boom.

Within the card industry, all eyes are now focused on the sharp increase in unemployment. At Citigroup, executives noted that the company’s 10.2 percent credit card charge-off rate for the first quarter had broken its “historic correlation with unemployment” and showed no sign of letting up.

American Express, Bank of America and Capital One Financial showed first-quarter loss rates that hovered around 8.5 percent, roughly tracking the unemployment rate. All three said they expected higher losses in the coming months. Even Chase Card Services, which charged off just 7.7 percent of its card loans in the first quarter, expects its loss levels to surpass unemployment by the end of the year.

Consider that with this table of consumer credit from the Federal Reserve:

Click for a larger image.

Click for a larger image.Consumer credit contracted in 4Q08 and is on track to do so in 1Q09.

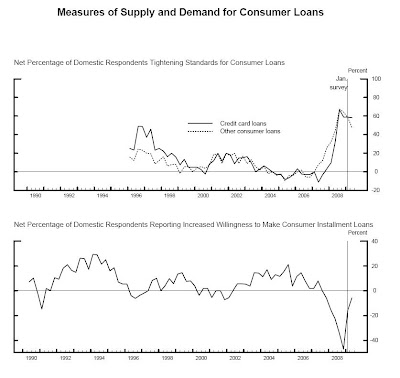

And these charts from the senior loan survey:

Finally, here is a chart of consumer loan demand:

Here's what the survey said about the information portrayed in the charts:

Consumer lending. Large percentages of domestic banks again reported a tightening of standards and terms on both credit card loans and other consumer loans over the previous three months. Nearly 60 percent of respondents indicated that they had tightened lending standards on credit card loans, about the same proportion as in the January survey. About 50 percent of respondents, down from 60 percent in the January survey, reported tightening standards on other consumer loans. About 50 percent of respondents reported having reduced the extent to which credit card accounts were granted to customers who did not meet their bank's credit-scoring thresholds, and a similar fraction reported pulling back from granting other kinds of consumer loans to such customers. Roughly 55 percent of the respondents, a somewhat higher proportion than in the January survey, reported having raised minimum required credit scores on credit card accounts over the previous three months. About 45 percent of respondents reported having raised minimum scores on consumer loans other than credit cards, and about 65 percent of banks, compared with 45 percent in the January survey, indicated that they had lowered credit limits to either new or existing credit card customers. In contrast to the substantial net tightening reported for consumer loan standards and terms, only about 5 percent of domestic banks, on net, indicated that they had become less willing to make consumer installment loans over the previous three months; this proportion is down from 15 percent in the January survey and 45 percent late last year. Regarding demand, about 20 percent of respondents, on net, indicated that they had experienced weaker demand for consumer loans of all types over the previous three months-substantially less that the percentage so reporting in the January survey.

So -- lenders are tightening their lending standards but are more willing to make loans. My guess is they simply want to make more prudent loans right now as opposed to the "you have a pulse so you get a loan" philosophy of the last few years. Considering the destruction of the consumer's balance sheet over the last few years (massive debt combined with asset deflation and weak job prospects) it's going to be harder for people to get loans.

Some of this is also the result of a higher savings rate:

All of this adds up to a declining year over year total of consumer credit outstanding, both for revolving and total credit.

Anyone that thinks consumer spending is going to get us out of the recession is sadly mistaken.