Y/O/Y inflation has remained stubbornly high for the last 6+ months

Import prices continue to rise, and

Producer prices continue to move higher as well.

Reference oil's chart below for its recent price movement. Here is a chart of gas prices from This Week In Petroleum, which shows prices are already dropping at the retail level:

However, this may not be the case with agricultural prices. While we've seen some noticeable drops in several commodities like corn:

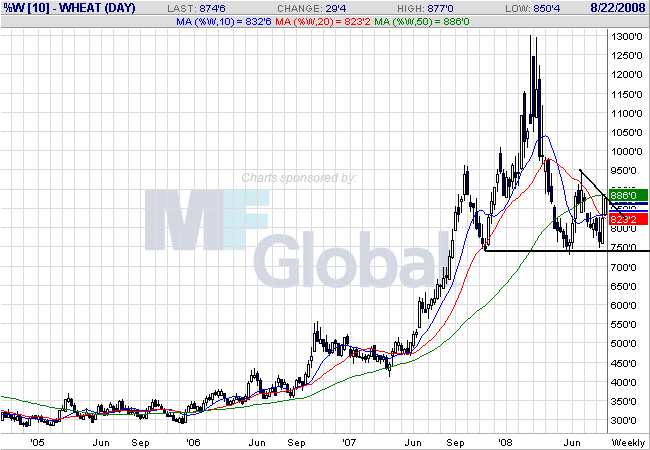

and wheat:

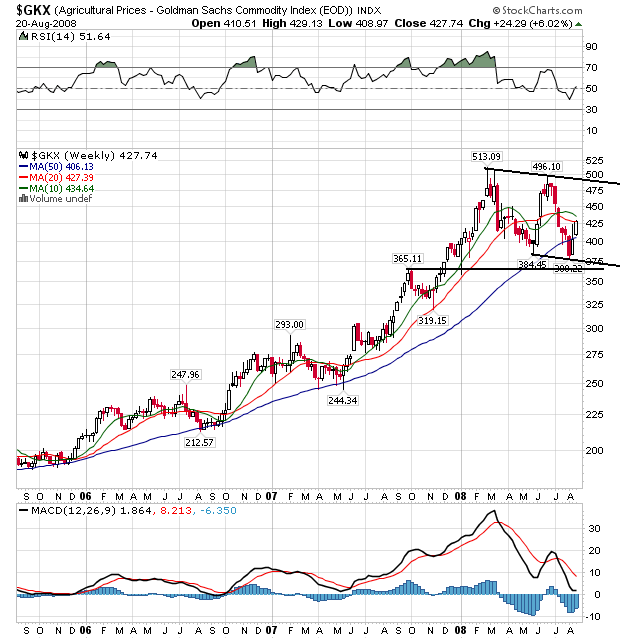

We're not need a commensurate drop in the overall price of agricultural prices:

On the weekly agricultural price chart notice the following:

-- Prices have been moving sideways with a slightly downward bias since mid-Spring

-- Although prices dipped below the 50 week SMA a few weeks ago, they are now above that important technical indicator

-- Prices and the 10 and 20 week SMA are caught in a tight range, indicating an overall lack of direction in the market.

This is a chart that says consolidation with a possibility of downward movement.

At the retail level, agricultural prices are a bit more stubborn than gas prices:

The economics of the food business are partly to blame. Though crude oil is the main ingredient of gasoline, processed foods like cereal, crackers or cookies use only a small amount of corn, wheat and other grains, limiting manufacturers' pricing power.

"Basically, there's only a few cents worth of corn in a box of corn flakes, so food prices are much slower to react to the downside than energy prices, " said Richard Feltes, senior vice president and director of commodity research for MF Global in Chicago.

Another factor keeping food prices high: Though commodities prices have fallen from record levels, they're still well above historical levels. Corn and soybeans have dropped 24 percent and 17 percent, respectively, in the last two months but are still about double where they were two years ago.

These are interesting points, and ones I hadn't considered (largely because I didn't know about them). Basically, oil is a big part of gasoline but corn and wheat aren't as big part of the final food product. That means lower raw materials prices don't necessarily translate into lower final products prices.

Refer to the corn and wheat charts above. Note they are at very high levels even after coming down. Both wheat's and corn's price is more than double since 2006 which will have a negative impact on food prices.

But also consider this:

Looking ahead to next year, economists see a mixed bag for American consumers. While falling grain prices should slow the rate of increases for baked goods, the USDA's Leibtag says people can expect to pay more for other items like beef, pork and chicken.

That's because as grain markets took off, the cost of corn- and soybean-based animal feed skyrocketed. Now, livestock owners — who spend half or more of their production costs on feeding their animals — have had to thin the size of their herds and flocks to deal with the increases. Cow slaughter has jumped 22 percent over last year, while hog slaughter is up 10 percent.

Much of that meat has gone into freezers to handle excess supply, but as the inventory dwindles, livestock owners won't have the money to replenish their herds to meet demand.

"That's going to have some serious consequence at the retail level," said Jesse Sevcik, vice president of legislative affairs at the American Meat Institute. "The only thing left is for prices to go up."

Expensive animal feed has also battered poultry producers, who so far have resisted passing on those costs to consumers to safeguard chicken's image as a good value compared to ribeye steaks and pork chops. But that's about to change, said Bill Roenigk, senior vice president of the National Chicken Council.

"From a consumer standpoint, more and more of these feed costs are going to be passed on and that means higher prices at the supermarket," said Roenigk.

Falling grain prices have taken some

In other words, there is a longer cycle of food cost increases. It's similar to dropping a stone in a pond; some ripples don't appear for awhile.

Either way, this article has gotten me thinking about he future inflation picture and wondering whether the drop in commodity prices will lower prices at the retail level in a significant way.