Federal Reserve Chairman Ben Bernanke's warning this week about the dollar's steep fall marks the latest step in a Bush administration effort that began in November to use stronger rhetoric to try to prop up the sagging U.S. currency.

The stepped-up rhetoric comes as the world's economic powers prepare to gather in Japan next week for the Group of Seven meeting. The dollar, along with the U.S. economy, is expected to be a key topic of discussion. International concerns about the dollar have been growing as Europeans, in particular, fret about the falling dollar's impact on their exports to the U.S.

The article also made this observation:

The increased focus on the dollar represents somewhat of a gamble by Messrs. Paulson and Bernanke. Their bet is that as the housing crisis subsides and the Fed finishes cutting interest rates, the dollar will climb -- making their rhetoric seem like it is having an impact.

ECB President Trichet said something similar on Thursday:

European Central Bank President Jean-Claude Trichet said Thursday that inflationary pressures in the euro zone will last longer than previously expected, with risks to price stability increasing further in the wake of robust food and oil prices.

The ECB may even raise its 4.0% interest rate, left unchanged on Thursday, at its July meeting, Trichet said. "I don't say it's certain, I say it's possible," he said.

Inflation trends have put the ECB in a state of "heightened alertness," Trichet said after the Governing Council meeting in Frankfurt.

.....

His more hawkish slant was further underscored by the bank's new staff projections for economic growth and inflation over the next two years. Inflation in 2009 is seen at around 2.4%, Trichet said.

Any projection for inflation in 2009 above 2.3% is "an unexpectedly hawkish signal," said Holger Schmieding, an economist for Bank of America.

"A number of us (on the Governing Council) "thought there was the case for raising rates," but Thursday's decision was taken by consensus, Trichet told reporters.

So -- we have dueling central bankers (as it were). The only difference is Trichet has a history of acting on his statements, whereas the US is the talker not the doer in the central bank world. That's a big difference and it boils down to a massive credibility gap for the Fed.

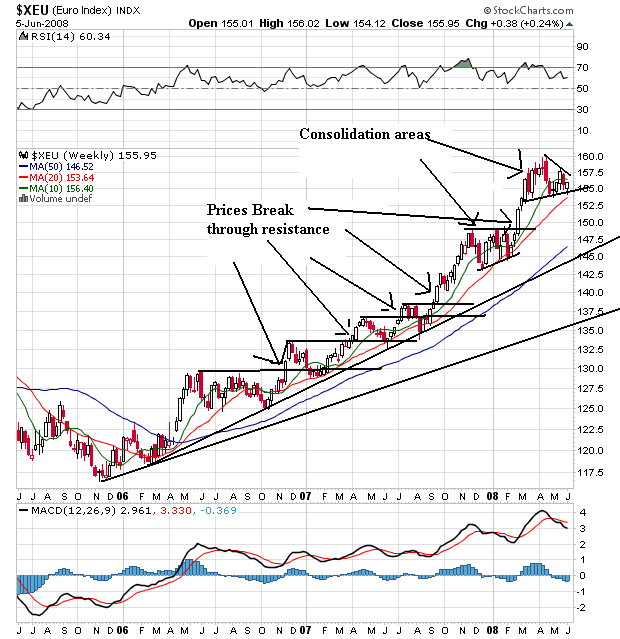

Let's start this week with the euro and review it's weekly chart:

This is a great bull chart. Notice the prices have continually advanced through resistance and then consolidated gains. Also notice the shorter SMAs are above the longer SMAS and all all the 20 and 50 day SMA are moving higher. The 10 is curving lower right now and prices are caught between the 10 and 20 day SMA.

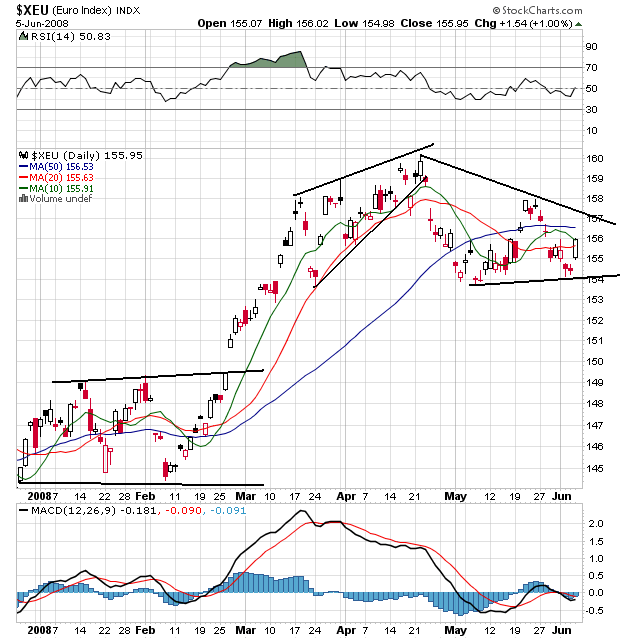

On the daily chart, notice that prices consolidated at the end of 2007 and beginning of 2008. They broke through resistance in late February, peaked in late April and have come down a bit since. Right now prices are bunched up with all the SMAs in s a consolidation pattern. But notice the big pop today after the ECB comments.

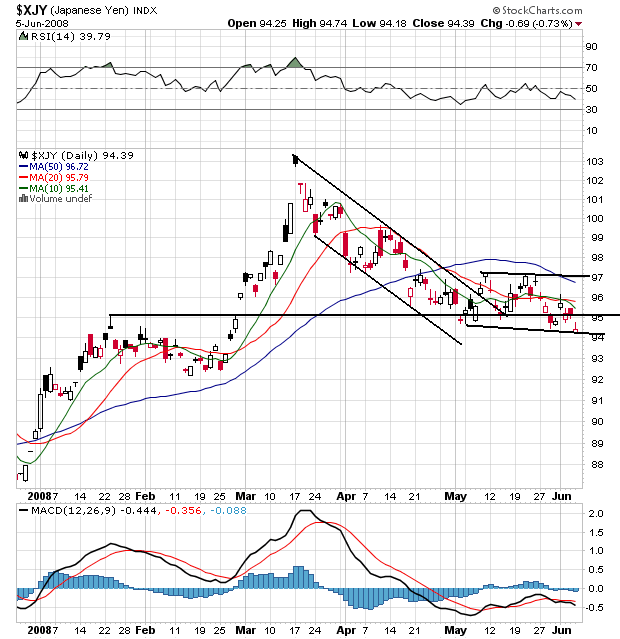

The yen has been in a rally since mid-2007. Notice that as the index rose prices took time to consolidate gains. Also note that consolidation was sharp. Right now prices have dropped below the 20 week SMA which will contribute to that SMA moving lower. Also note the 10 week SMA is about to cross below the 20 week SMA which is a bearish development.

On the daily chart, notice that prices advanced from the beginning of the year through mid-March. Since then they have come down a bit and consolidated horizontally. Note that prices and all the SMAs are bunched together right now, indicating a lack of direction.

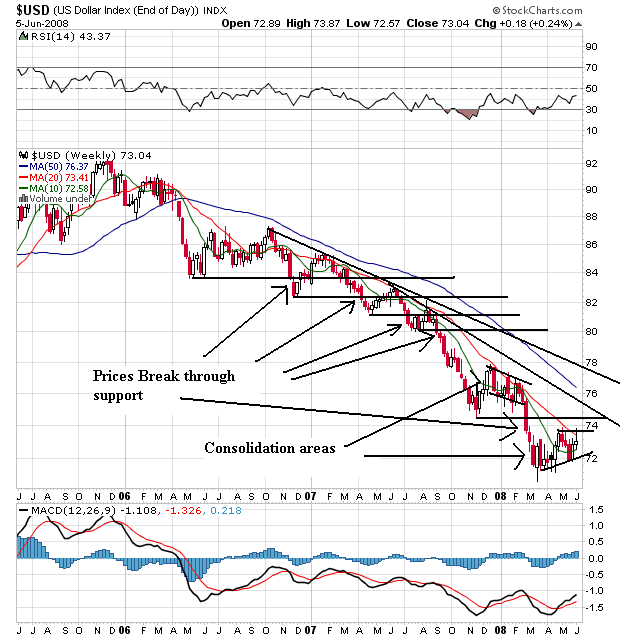

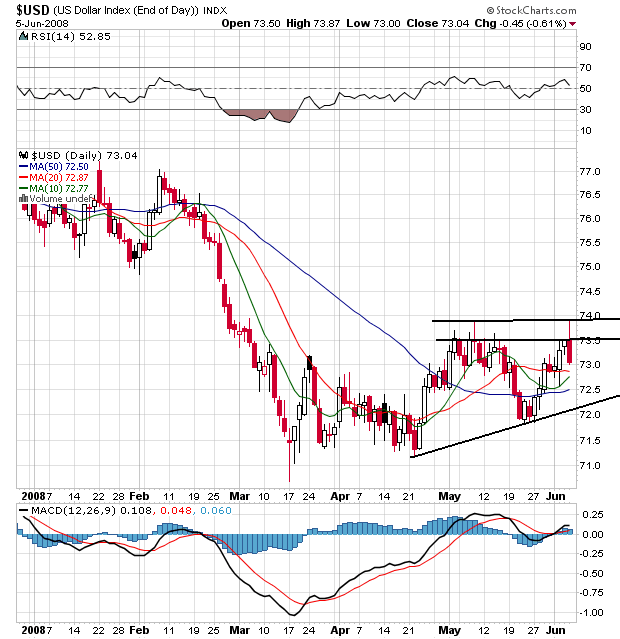

One of the nest examples of a bearish chart I have ever seen. Prices have been moving lower for two years, with prices continually breaking through support to make new lows. Note the 20 and 50 day SMA are both moving lower. The 10 week SMA is about to move a bit hight, but it has done this before at the beginning of the year with no success.

On the daily chart, notice the dollar has rallied a bit since the end of April. Also note that prices are above the SMAs which will pull them higher. Bernanke's statements jawboning the dollar may help in the short run, but we'll need action for this chart to turn around.