Americans feeling the pain of record gasoline prices now face the likelihood of another fuel shock, from natural gas.

Prices in the U.S. have risen 93% since late August as power-hungry nations like South Korea and Japan compete in a global natural-gas market that scarcely existed a half-decade ago. Still, U.S. prices are as low as half the level of some overseas markets, suggesting they have much further to rise.

The global appetite for natural gas has profound implications for a U.S. economy already tipping toward recession and struggling against inflation pressures. The fuel heats half of U.S. homes, generates 20% of the country's electricity and is used to make everything from fertilizer to plastic bags. In March, rising natural-gas prices contributed to a higher than expected 1.1% increase in producer prices, according to the Labor Department.

U.S. natural-gas output has actually been rising in recent months, and not everyone agrees that prices are destined to surge. However, a significant number of financial players are now betting on an increase.

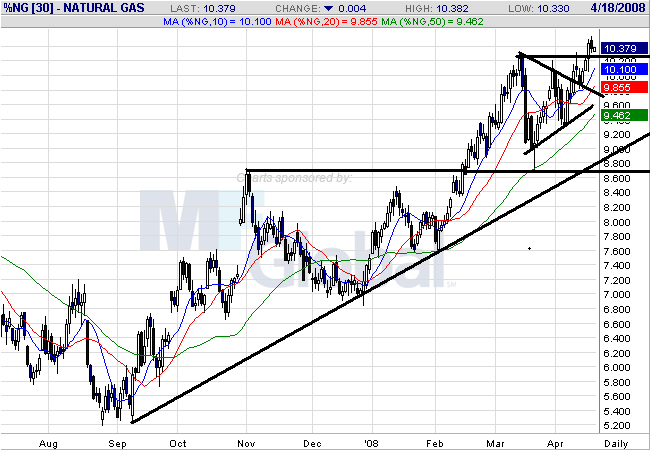

Let's look at the chart to see what's going on.

The above chart shows a strong rally. Notice the following:

-- Prices have almost double since last September

-- All the SMAs are moving higher

-- Prices are above the SMAs

-- The shorter SMAs are above the longer SMAs

-- There is a strong uptrend in place

However, the multi-year chart shows the natural gas market is especially prone to price spikes. So, that's what we could be dealing with here.