The Commerce Department reported Monday that retail sales edged up 0.2 percent in March after a 0.4 percent decline in February. The March gain primarily reflected higher costs for gasoline, which climbed to record highs. Excluding a big 1.1 percent rise in sales at gasoline service stations, retail sales would have been flat last month.

So -- without this:

There would be no gain. That's really comforting.

This really isn't that complicated.

Declining employment

Leads to lower income

Leads to declining sentiment

And declining confidence

Leads to lower outlays

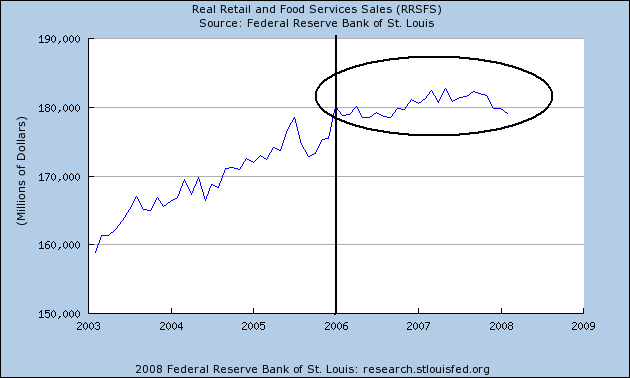

More importantly, look at this chart of real (inflation adjusted) retail sales from the St. Louis Federal Reserve

Sales have been flat for about two years.

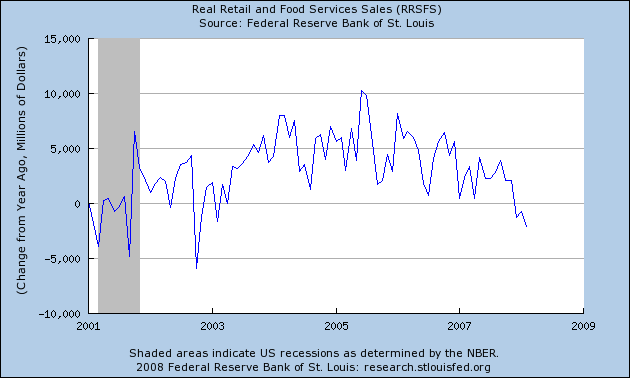

And the year over year chart is not negative -- which is definitely not good.